This material is marketing communication.

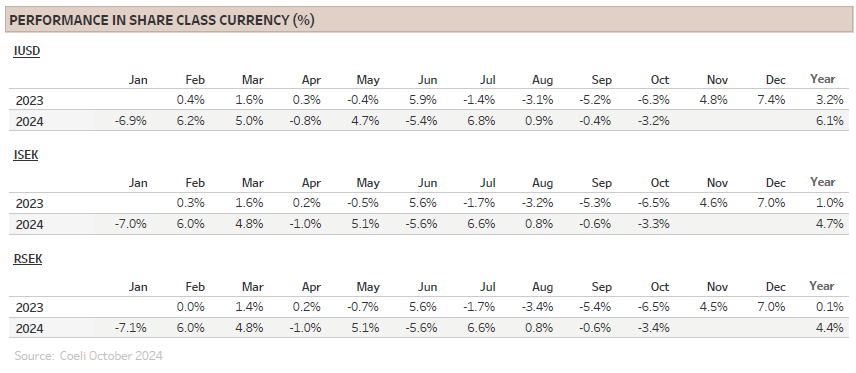

Note that the information below describes the share class (I USD), which is a share class reserved for institutional investors. Investments in other share classes generally have other conditions regarding, among other things, fees, which affects the share class return. The information below regarding returns therefore differs from the returns in other share classes.

Past performance is not a guarantee of future returns. The price of the investment may go up or down and an investor may not get back the amount originally invested.

1) Share Class I USD

Performance for other share classes towards the end of the report.

FUND MANAGER COMMENTARY

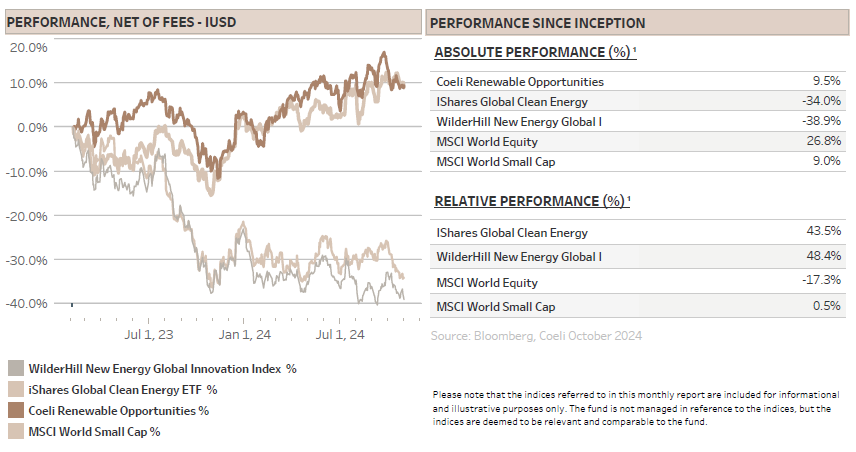

The Coeli Renewable Opportunities fund lost 3.2% net of fees and expenses in October (I USD share class). It has increased 6.1% year to date and is up 9.5% since the inception in February 2023.

In October, the fund outperformed the most comparable indices, the Wilderhill New Energy Global index (NEX) and the iShares Global Clean Energy (ICLN) by 5.9% and 7.6% respectively. It increased the year-to-date outperformance to 26% and 22%, respectively and the fund is ahead by 48% and 44% since inception in February last year.

October marked a period of intense preparation for and pre-trading of the US presidential election. As highlighted in the two previous monthly reports, the election presented a binary risk for renewable equities. To mitigate potential volatility and drawdowns, we reduced the net exposure and skewed positions to Europe into the event. Although vice-President Harris was leading in the polls well into the last week of October, renewable energy equities took a beating as the market, correctly, increasingly weighed former president Trump’s lead in the betting markets.

The two pure short hydrogen themes were not surprisingly the best performers, adding a combined 3.1% to NAV and more than recovering the loss from September. In contrast, the ‘Solar’ theme detracted 2.6% of NAV, mainly driven by the decline in residential solar stocks, which had significant upside potential would Harris have won. Additionally, First Solar (FSLR), the biggest winner from the Inflation Reduction Act (IRA) took a beating as the odds of a red sweep improved. Moreover, since the bond market feared his fiscal policies more than Harris’, long-term Treasury yields rose significantly. This impacted not only our rate sensitive theme ‘US Renewable Developers’, deducting 2% from NAV, but also dragged down ‘Grid Owners’, a theme with only long holdings in owners of European electrical grids. The ‘Wind’ theme also performed poorly, and we exited Vestas (VWS), a long-held position where we saw the risk-reward getting worse. More on that in the fund performance part.

MARKET COMMENT – FOCUS ON THE US ELECTION

The S&P 500 declined by 1% in October, only its second down month this year. The index sold off into month-end as Harris’ betting odds saw a modest rebound. However, the so-called ‘Trump’ trades, i.e. baskets of stocks expected to benefit from a Trump victory, outperformed their ‘Harris’ counterparts by as much as 16% over the month. With hindsight, the market was never really in doubt about the outcome.

It was not only renewables energy equities, an important part of the Harris trade baskets, that suffered from Trump’s election momentum. The Eurostoxx 50, Europe’s leading blue-chip index, declined by 3.4% in October, its worst month since October last year. At the time of writing, the Eurostoxx 50 has underperformed the S&P 500 by nearly 8% during November and is lagging by as much as 23% in USD this year. The market is clearly expecting American exceptionalism, and that Europe will be a loser from Trump’ tariffs.

In addition to Trump’s promise of universal tariffs on friends and foes alike, he has also campaigned on significant tax cuts on top of extending his own Tax Cuts and Jobs Act (TCJA) from 2017. Parts of the TCJA is sunsetting in 2026 and will need to be extended next year at an estimated cost of more than USD 4tn. Although Trump has vowed to keep inflation low and reduce the fiscal deficit, the market is, for now at least, questioning the feasibility and has as a precaution sent long term yields higher.

The job of the Federal reserve (FED), which must prepare to play second fiddle for the next four years, also became much more difficult. FED Chair Powell refrained from speculating on future actions until after the new administration has announced its policies following the inauguration in January. However, the bond market has since Trump took a decisive lead in late September, it is expecting almost four fewer rate cuts by the end of 2025. Nevertheless, as inflation, for now, seems to be under control and the labor market is balanced, the bond market still predicts a further FED cut in December and two more in 2025. So far so good for ‘Making America Great Again’.

RENEWABLE ENERGY – THE ENERGY TRANSITION DOES NOT STOP WITH TRUMP

We cannot deny that we were hoping for another outcome of the US presidential election. Although we are convinced that the energy transition will not stop with President Trump, we do believe his administration will hamper the fight against climate change by prioritizing burning of fossil fuels and equally important, giving other countries cover to delay their own climate goals.

President-elect Trump has called climate change a hoax and described President Biden’s climate agenda as a green scam. Moreover, he has promised to not only roll back environmental regulation and to promote fossil fuels, but he also wants to revoke the landmark Inflation Reduction Act (IRA). Since the Republicans won a red sweep, controlling both Houses of Congress and the presidency, the probabilities of delivering on campaign promises have increased. However, there are still some limitations to what he will and can do, we believe.

Revoking the IRA?

Revoking the IRA was an easy campaign promise, but as we have discussed in many monthly reports, it is unlikely to be repealed—even in a red sweep. First, about 80% of the IRA funding has gone to red states, and 7 of the 10 fastest growing states in terms of clean energy jobs are represented by Republican Senators. Additionally, prior to the election, 18 Republican House members opposed revoking the IRA and 14 of those were re-elected. The slim Republican majority will likely make a repeal very challenging.

Second, while Republicans and Democrats disagree on many issues, they both prioritize domestic manufacturing and reducing reliance on China. Repealing the IRA would hinder US-made equipment production, cut American jobs, and benefit China -outcomes neither party supports.

Third, power demand is set to grow significantly in the coming years due to AI data centers, onshoring of manufacturing, and increased electrification. Reducing energy supply by limiting wind and solar development would be counterproductive, especially when Trump has promised to halve energy costs. Power prices are already rising, and disincentivizing clean energy would only increase them further. Notably, although Trump is an outspoken critic of windmills, more onshore wind was installed during Trump’s term than under Biden.

Finally, it is unclear how much funding could realistically be saved by revoking the IRA. The US has historically grandfathered private investments triggered partly or fully by US government incentives. Withdrawing these subsidises on existing assets would sow financial chaos since many are tied up in complex tax equity agreements. Even projects under development have historically been safe harboured as long as a relatively small amount (~5%) of total cost has been spent.

Still, the republicans need to find about USD 4 trillion of savings in order to extend the TCJA, the tax cuts from Trump’s first period, and even more if he is going to honor his many campaign promises of lower taxes. Although we do not believe in a full IRA repeal, certain provisions will likely be rolled back.

Changing the IRA?

What is on the chopping block? There is general agreement that direct credits like the EV subsidy of USD 7,500 per car is an easy target. Elon Musk, for one, is against this credit, probably because it benefits his competitors more than him. Another low-hanging-fruit for the Republicans is to set a firm phase out date for all of the IRA tax credits. Currently, some tax credits are phased out ‘the later of 2032 or when emission targets are met’, referring to a 75% carbon emission reduction from a 2022 baseline. This target might not be achieved until the late 2040s, leading to potentially high and uncertain costs. The Republicans will likely push to curtail the IRA even earlier than 2032, which, as we have seen before, could ironically spur a rush from renewable developers to lock in incentives. This could counterintuitively have a positive effect on share prices within the renewable energy space.

What is likely not on the chopping block? This is by no means an exhaustive list and based on our best judgement. The most secure elements are manufacturing tax credits, which have created too many jobs to risk cutting. Domestic content adders also have bipartisan support for boosting US production and are likely to survive in some form. Investment and production tax credits for solar and wind are likely to continue, though with possible duration cuts, as described above. These credits have expired and been reinstated multiple times over recent decades, including during President Trump’s first term. This would be positive, at least in relation to the doomsday scenario the market has priced in. However, uncertainty will remain for some time.

Another safe bet is that the Republican Congress will try to stop China from benefitting from any IRA tax credits. There is already a bipartisan legislation, the foreign entity of concern (FEOC) limiting companies from certain countries, including China, to participate in the EV industry. This legislation may be extended to supply chains for solar, wind, critical minerals, and batteries. While this would solidify manufacturing credits for domestic producers, it risks leaving them short on components, especially in battery production, where U.S. supply chains are underdeveloped. We suspect ‘efficiency czar’ Elon Musk might not be totally supportive if this would make it difficult to produce Tesla batteries in the US. One winner though would be solar panel producer First Solar (FSLR), which sources most components domestically and importantly, nothing from China.

Trump's Executive Power Over the IRA

In the short term, Trump’s executive power could do more harm to the IRA than Congress. He can and probably will delay and limit the implementation of certain provisions and implement stricter eligibility requirements for e.g. domestic content adders. Additionally, any IRA guidelines not finalized before election night - and rushed through before inauguration - could be subject to Congressional review. This includes guidelines for green hydrogen and clean fuels. We do however believe there is bipartisan support for the clean fuel credits, and we own a few stocks in this space. On the other hand, as we have discussed many times before, we are very skeptical to the broad application of green hydrogen across the economy and the fund would benefit from more realistic hydrogen incentives.

Trump and regulation – not all doom and gloom

Trump has pledged to roll back major EPA regulations, including the EPA Power Plant Rules requiring coal plants to cut emissions by 90% by 2032. This would likely stall or delay the phase-out of coal power in the US. It would also reduce the demand for renewables, although hyperscalers with strict carbon goals will likely continue investing in clean energy to offset fossil fuel use. For reference, in the U.S. over the past five years, four companies (Microsoft, Meta, Amazon and Google) accounted for about 70% of the Corporate PPA market and ~40% of all U.S. utility-scale solar demand, according to UBS.

By the same token, Trump wants to scrap the electric vehicle mandate, which will delay the transition to electric vehicles in the US. Both changes will face significant legal challenges, but with control of Congress it is likely just a matter of time before he will win through. Perhaps his best buddy Musk might persuade him that phasing out coal and promoting EVs would be better for the U.S.

It is not all doom and gloom though. The two largest bottlenecks for renewable energy developments in the US today is permitting and grid connection, not demand. While bipartisan attempts at permitting and interconnection reform have been ongoing for the past two years, a Republican majority might pass a more streamlined bill, albeit fossil-fuel-leaning. Such a bill could be even more effective in removing red tape and reducing interconnection queues. Trump and the Republicans are committed to a strong economy with abundant, affordable energy, making it likely they will prioritize efforts to “make the grid great again.” Since the expansion of the grid is where we have our largest exposure currently, this would be a positive development.

Universal tariffs, targeted tariffs or both?

One of Trump’s campaign promises that has concerned economists the most is the threat of universal tariffs of 10-20% on all import to the US and targeted tariffs like 60% on China or 200% on Mexican produced cars. Most economists agree that tariffs typically result in higher inflation and slower economic growth, affecting not only the exporting countries but also the US. For example, Morgan Stanley estimates that a 10% universal tariff could lower US GDP growth by 1.4% and increase inflation by 0.9% - and that is before factoring in potential retaliatory tariffs from China, Europe, and other partners.

However, it is uncertain which of Trump’s statements are campaign rhetoric, negotiation starting points, or firm policy goals. In his first term, Trump aimed to reduce the trade deficit, often escalating tariffs if trading partners did not meet his demands. Many expect trading partners may be more accommodating this time around to avoid mutual damage. Yet, Trump's objectives now also include using tariff revenues to finance an extension of the TCJA.

It remains unclear whether Trump can introduce universal tariffs without Congress’ consent. In 2017, he was blocked by a Republican-controlled Senate, and many of those Senators fronting the clash with the president still remain in office. They might continue to be unwilling to risk disrupting the global economic order, which most believe, or at least used to believe, have served the US well. The fact that the Republican senators chose their leader in a secret ballot and avoided to pick the most die-hard Trump supporter signals that there might still be some ‘adults in the room’.

Although difficult to predict how hard Trump will push for universal tariffs, it is safe to assume that further charges will be targeted at Chinese companies. Since the solar industry is totally dominated by Chinese equipment companies, although little is sold directly from China to the US, higher tariffs will likely result in price inflation and lower demand for solar in the US.

That said, the impact may not be as severe as expected given the current bottlenecks in permitting and interconnection, as well as ongoing anti-dumping and anti-circumvention investigations into imports from Southeast Asia. Still, growth expectations in the solar industry may need further adjustment until a U.S.-based supply chain can meet demand - a goal dependent on manufacturing tax credits.

Intrest rates – higher for longer?

Most economists agree that potential tariffs and unfunded tax cuts could drive higher inflation and increase government deficits, likely compelling the Fed to hold off on rate cuts and pushing up long-term yields. This trend has already begun since Trump’s significant lead in the betting markets in mid-September. Since then, the bond market has priced out four of the six anticipated Fed rate cuts for next year, while the 10-year Treasury yield has jumped over 80bps in just two months.

Higher rates are a clear headwind for the renewable energy sector, which is capital-intensive, often heavily leveraged, and may not see positive cash flows for years. Valuations will likely need to adjust, as we have seen in recent weeks. However, the market does adapt, and renewable developers’ returns have actually risen over the last three years of high or increasing rates. This has helped not only to offset higher interest costs but also to increase returns, compensating for the higher cost of equity.

Will Trump Push for Peace in the Ukraine?

Trump has pledged to broker peace in Ukraine on day one, an unlikely feat, yet his influence as the US's top defense donor could help end or freeze the conflict, allowing Ukraine’s reconstruction to begin. Although it will not be the outcome Ukrainians wanted, Trump's leverage might enable a face-saving compromise they otherwise could not accept. We may even see some concessions from Putin, although we are not holding our breath.

For energy markets, a peace deal could come with the requirement that Europe allows an increase of Russian gas imports. This will likely be one of Putin’s demands. Although Europeans will likely pretend to resist, the fact is that Russia is still a large exporter of gas to Europe. Even though import through pipelines is about to end, Europe is still buying significant volumes of the more expensive LNG from Russia. While Europe may never be as dependent on Russian gas as before, we believe cheap Russian gas could flow to Europe soon after peace is agreed.

This influx could depress European gas prices around 2026-2028 as it would coincide with a major increase in global LNG supply from Qatar and the US. While Asia may absorb much of this LNG through coal-to-gas switching, it would mean lower global gas prices and since European power prices are still gas-linked about 60-70% of the time, this could have severe impact on European power prices. Note that power prices are still twice as high as pre-Ukraine war.

As we already had a bearish medium-term view of European power prices and are short a few of the, in our view, expensive power producing companies, this outcome might be beneficial. It will at least offer good trading opportunities.

What happens next?

As was generally expected, the renewable energy space sold off hard on the Trump win and the red sweep. Equity valuations reset quickly, and a lot of potentially negative factors are now priced into the stocks. Industrial companies focused on building out the grid, however, generally did well.

Over the next two months until the inauguration, the market will be in a limbo trading whatever signal Trump and the Republicans send on tariffs, IRA repeal and tax cuts. Post-inauguration, much will depend on the Republican Congress. While they can legislate without much input from the Democrats, high voter expectations following the red sweep means the Republicans now bear full responsibility. If tariffs do not cover tax cuts, or if inflation and high rates slow the economy, they will not have obstructionism from their opponents to blame. We expect Republicans the next months will likely scale back ambitious promises, tone down the worst rhetoric, and focus on realistic goals.

Unfortunately, clarity on IRA changes through budget reconciliation, the only way to change the IRA as the Republicans do not have super majority in the Senate, may not come until late April or even late summer, just before the September debt ceiling deadline. With worst-case scenarios nearly priced in, this period offers trading opportunities as volatility is likely to stay elevated.

In the longer term, a Trump presidency may not favor the climate, but it could benefit renewable stocks. History shows renewable equities performed exceptionally well during Trump’s first term (up 250-500%) compared to Biden’s term (down 60-70% and counting). As we have long argued, government-driven capacity increases can often hurt incumbents by creating more competition and driving down prices and returns - a note of caution to oil and gas investors celebrating Trump’s “drill-baby-drill” agenda.

FUND PERFORMANCE – FOCUS ON PROTECTING THE DOWNSIDE

October marked the fund's third-worst month of the year with a drawdown of 3.2%. However, it was the third-best month in relative terms since inception, outperforming the most comparable indices, the Wilderhill New Energy Global Index (NEX) and the iShares Global Clean Energy ETF (ICLN), by 6.8% on average.

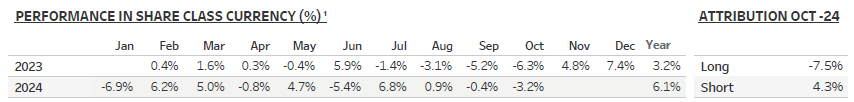

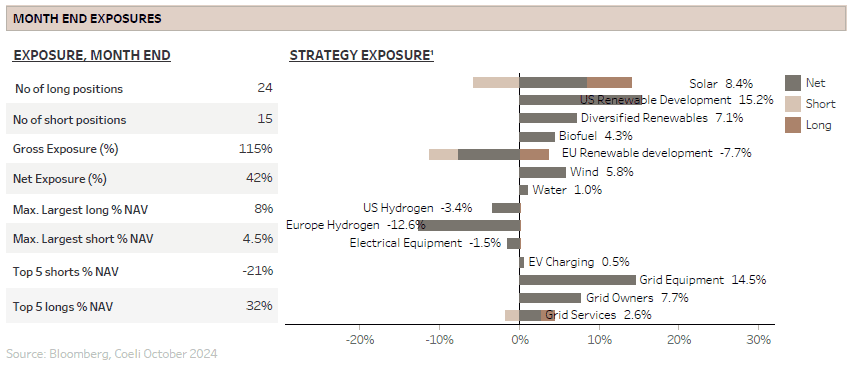

As renewable energy stocks sold off into the US election, half of our investment themes were down on the month. Long positions lost 7.5% while shorts gained 4.3%. Net exposure remained in the low 40% for most of the month, near the low end of our target range of 40-80%. The gross exposure ended October at 113%.

Our investment universe is a story of two tales, on the one hand, renewable energy stocks are trading at significant discounts to historical valuations while many of the grid-exposed stocks, particularly in the US are trading at substantial premiums. More broadly, the US stock market is highly priced by most metrics, which makes us slightly more cautious as well.

During the month, we added short exposure in the electrical components sector in the US. We believe the company is overvalued and it is already selling at its max capacity, limiting near-term revenue growth, earning peak gross margins, limiting further earnings growth, while competitors are adding supply, a potentially dangerous combination. We are on the look-out for more of these cases were the supply-demand balance are about to shift the negotiation power.

The two best performing themes of the month were the two hydrogen themes, which recovered from a short squeeze in September. ‘EU Hydrogen’ added 2.7% to NAV while ‘US Hydrogen’ gained 0.5%. The news flow in the hydrogen space is simply dreadful as most projects are delayed or cancelled outright. As we previously discussed, the Trump administration is unlikely to have positive implications for the hydrogen provisions in the IRA.

The third best performing theme adding 0.4% to NAV was ‘Diversified Renewables’ where we had added some small positions in a couple of Bitcoin miners. Our original interest was not in the business of bitcoin mining, but the investment case rather rests on the excess value in the power contracts and grid connections of these miners. However, into the election we increased the positions as a hedge against a Trump victory. Although the share prices fluctuate with the volatile bitcoin price, we still believe there is significant upside value as mines are converted to sell data center capacity.

The worst performing theme was ‘Solar’, deducting 2.6% from NAV. The main culprit was the residential solar players which declined in line with Harris’ performance in the betting market. We expected the stocks to more than double in the case Harris would win, but the symmetry on the downside was stronger than expected into the election. We have exited these positions post the election, but we will continue to keep an eye on them as residential solar continues to be part of the energy solution in the US.

First Solar (FSLR), our only large remaining position in solar, faced a sharp selloff in October, dropping over 20% as House Republicans gained in the polls. While we believed a Trump victory with a divided government would be bullish for FSLR, tax credits protected and tariffs introduced on Chinese competition, a red sweep however could open the door to an IRA repeal. Despite this, as we believe manufacturing credits will be preserved coupled with the potential for higher tariffs on competitors’ imports, FSLR’s outlook remains strong, we believe. We expect volatility until there is greater clarity on IRA and tariff policies.

The second worst performing theme was ‘US Renewable Development’, losing 2.0% of NAV. This theme includes Nextera Energy (NEE) and AES, two large renewable energy developers we have discussed in previous monthly reports. AES, in particular, sold off sharply as the market priced in a Trump win. The company got a double whammy from rising US long-term yields, which negatively impact its valuation due to high leverage albeit mostly non-recourse debt.

The sharp rise in long term rates in the US was contagious and pulled up European yields as well. This hurt our ‘Grid Owners’ theme which lost 0.8% on the month. These grid companies are not impacted by US politics and their regulated return is over time adjusted to the interest rate level. We have added to the positions on this weakness.

The third worst performing theme of the month was ‘Wind’, deducting 1.2% from NAV. In this theme we finally exited the rest of our shrinking Vestas (VWS) position. We had long been hopeful to Vestas as the leading wind turbine manufacturer in a growing but concentrated industry with high entry barriers yielding pricing power and stronger margins. We expected the margin recovery coming out of Covid to continue and the company to get within reach of its 10% EBIT margin target next year.

However, several factors have forced us to reevaluate:

1. Disappointing Onshore Orders: Weak US orders hurt fixed cost absorption.

2. Elevated Warranty Costs: These remain far above the 2% target, with poor visibility on normalization.

3. Service Margin Concerns: A profit warning on service contracts, traditionally a key strength of their business, suggests cost inflation was underestimated, raising long-term margin risks.

4. Weak Offshore Order Intake: While not impacting near-term EBIT, this reduces long-term potential and raises doubts about offshore profitability.

5. Chinese Competition: We are less confident that Chinese OEMs will be excluded from Western European markets, and other regions except the US may lean toward Chinese suppliers.

Finally, the company was reporting results on the day of the US election and with our focus on reducing risk and especially risk linked to a Harris loss, cutting the full position became an obvious choice. The company reported very weak Q3 results and fell 23% over the next two days.

Sincerely

Vidar Kalvoy & Joel Etzler

Past performance is not a guarantee of future returns. The price of the investment may go up or down and an investor may not get back the amount originally invested.

- Portföljförvaltare och grundare av fonden Coeli Energy Opportunities.

- Mer än 15 års erfarenhet av investeringar från både publika och private equity-sidan.

- Förvaltade fonden Coeli Energy Transition under perioden 2019 - 2023.

- Spenderade sex år på Horizon Asset i London, en marknadsneutral hedgefond.

- Började arbeta tillsammans med Vidar Kalvoy 2012.

- Fem år inom Private Equity på Morgan Stanley.

- Startade sin investeringskarriär inom tekniksektorn på Sweden Robur i Stockholm 2006.

- Utbildad Civilingenjör från Kungliga Tekniska Högskolan.

- Portföljförvaltare och grundare av Coeli Energy Opportunities-fonden.

- Förvaltat aktier inom energisektorn sedan 2006 och har mer än 20 års erfarenhet från portföljförvaltning och aktieanalys.

- Förvaltade fonden Coeli Energy Transition under perioden 2019 - 2023.

- Ansvarig för energiinvesteringarna på Horizon Asset i London under 9 år, en marknadsneutral hedgefond.

- Erfarenhet från energiinvesteringar på MKM Longboat i London och aktieanalys inom teknologisektorn i Frankfurt och Oslo.

- MBA från IESE i Barcelona och Civilekonom från Norges Handelshögskola.

- Innan han började arbeta inom finans var han löjtnant i norska marinen.

IMPORTANT INFORMATION. This is a marketing communication.

Before making any final investment decisions, please refer to the prospectus of Coeli SICAV II, its Annual Report, and the KID of the relevant Sub-Fund. Relevant information documents are available in English at coeli.com. A summary of investor rights will be available at https://coeli.se/finansiell-och-legal-information/. Past performance is not a guarantee of future returns. The price of the investment may go up or down and an investor may not get back the amount originally invested. Please note that the management company of the fund may decide to terminate the arrangements made for the marketing of the fund in one or multiple jurisdictions in which there exists arrangements for marketing.