This material is marketing communication.

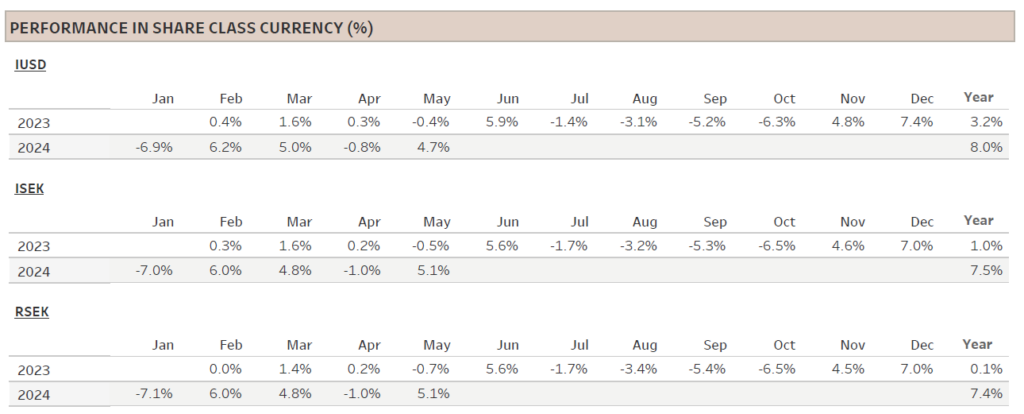

Note that the information below describes the share class (I USD), which is a share class reserved for institutional investors. Investments in other share classes generally have other conditions regarding, among other things, fees, which affects the share class return. The information below regarding returns therefore differs from the returns in other share classes.

Past performance is not a guarantee of future returns. The price of the investment may go up or down and an investor may not get back the amount originally invested.

1) Share Class I USD

Performance for other share classes towards the end of the report.

FUND MANAGER COMMENTARY

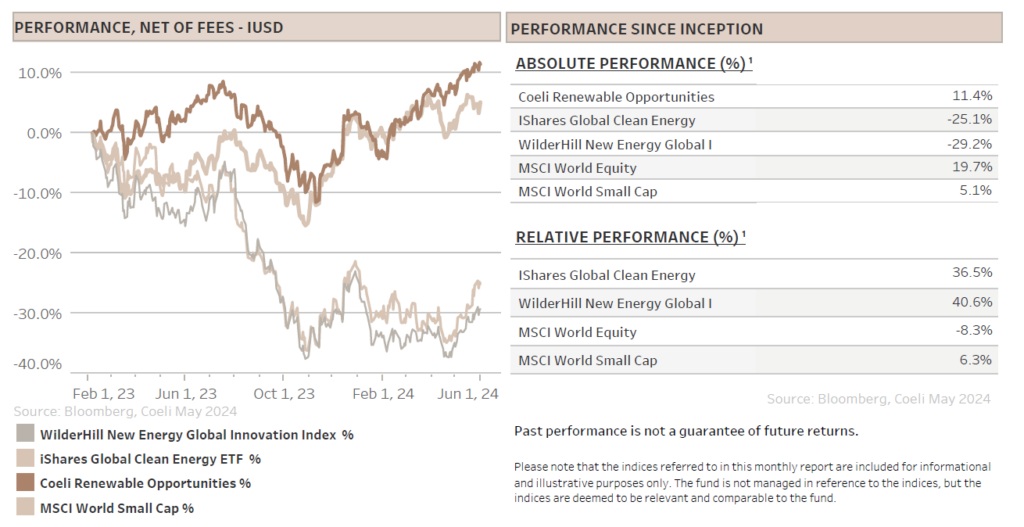

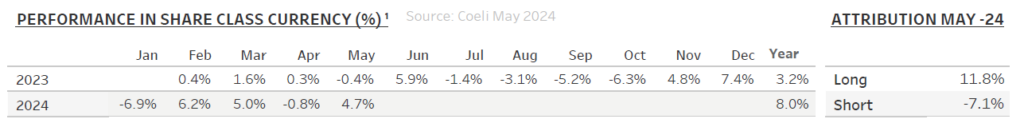

The Coeli Renewable Opportunities fund was up 4.7% net of fees and expenses in May (I USD share class). It has increased 8.0% this year and is up 11.4% since the inception on February 6, 2023.

In May, the fund underperformed the two most comparable indices, the Wilderhill New Energy Global index (NEX) and the iShares Global Clean Energy (ICLN), by 5.0% and 8.4%, respectively. Nevertheless, the year-to-date outperformance is still solid at 15% and 12%. Since inception, the fund is ahead by 41% and 37%, respectively. Over the last four months, the fund has outperformed the S&P 500 by 7%.

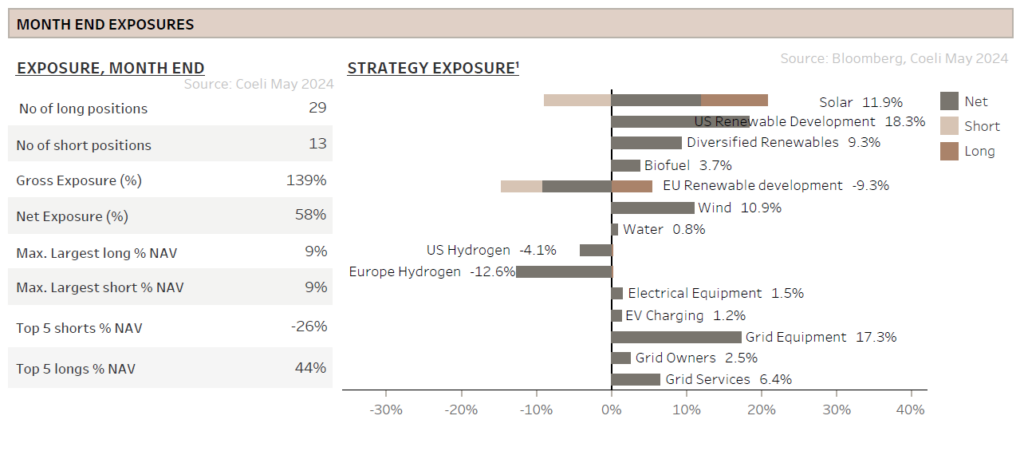

As both the general market and renewable equities rallied, it is not a surprise that our returns were made on the long side, which contributed 11.8% to NAV while the shorts lost 7.1%. Ten out of fourteen themes were up in May, led by “US Renewable Development” and “Solar” which added 3.1% and 2.5% to NAV, respectively. The primary driver of the performance was likely the enthusiasm around the opportunity of powering artificial intelligence (AI) data centres (DC). In “Solar”, the performance came mainly from First Solar (FSLR), which is arguably the largest AI winner in the solar space. We discuss FSLR and its unique tailwinds in more detail later in this report.

The worst performing themes were the two hydrogen themes which only contains short positions. Although there are some signs of optimism in the sector, we believe the main drivers were rather market momentum and short squeezes. We prepared for this risk last month by reducing the net short exposure, hence limiting the losses in the US Hydrogen theme to only 0.3% of NAV. Our negative view on hydrogen equities is if anything enhanced after this rally.

Net exposure was in the 50%-range for most of May and closed the month at 58%. The gross exposure was in the 130%-range most of the month and ended at 139%. The theme we previously called “Grid” is now split into four themes called “Grid Equipment”, “Grid Services”, “Grid Owners” and “Electrical equipment”. Although these stocks have had a great run year-to-date, we are still optimistic and looking to add to existing and new positions.

MARKET COMMENT – HOPE FOR A SOFT LANDING AGAIN

The S&P 500 rose 4.8% in May, recovering all of April’s decline and setting three new all-time highs during the month. The index is this year up almost 11% as of May. Although the rally was led by the ‘Mag 7’ and market breadth worsened as only 36% of the index’ 500 members traded above their 50-day average, the small cap index, Russel 2000, outperformed the S&P 500 slightly and the key renewable energy indices rose by between 10% to 20%.

It is somewhat surprising that rate-sensitive small caps performed so well, given that market expectations for FED rate cuts were pushed even further out in time and the US 10-year Treasury rate only declined slightly during May. However, as we wrote in the last monthly report, FED chairman Powell reassured the market by suggesting it was quite unlikely there would be any further rate hikes. This sentiment was reinforced by somewhat softer economic data in May, reviving market hopes for a soft landing. Another contributing reason for the rally in small caps was that enthusiasm around artificial intelligence (AI) spread to the renewable energy space.

RENEWABLE ENERGY – OPPORTUNITIES AND CHALLENGES IN US SOLAR

In May, the renewable energy indices experienced a significant rally, particularly in the solar space. The Invesco solar ETF (TAN) surged by as much as 20% despite mixed industry news flow and the bond market suggesting that interest rates will stay higher for longer. What fueled this sudden wave of optimism?

We believe the primary driver is the expectations of soaring power demand from AI data centres. In particular, a sell-side upgrade of First Solar (FSLR) argued convincingly that the company with its domestic supply chain and large US market share is a “first derivative” play on the AI boom. As FSLR is a relatively large clean tech company with a market capitalization of around USD 30bn, it is the largest constituent in many of these indices, particularly in the TAN where it with its 16% weight is the largest by a margin. As the stock gained 54% during the month, it pulled up the indices.

It was not all about AI demand though as FSLR is also benefiting from other factors. In late April, a group of US solar manufacturers, led by FSLR, petitioned the Department of Commerce (DOC) to open a new anti-dumping and circumvention (AD/CVD) case against Chinese companies operating through Cambodia, Malaysia, Thailand, and Vietnam. These four countries account for more than 80% of imported panels into the US, and the petitioners are seeking tariffs of up to 270%. Although the final tariffs, if any, are likely to be meaningfully lower but still significant, most experts believe the petitioners are likely to prevail. Moreover, there is a significant risk that tariffs will be retroactive to at least April.

Recall that when the DOC took up a similar AD/CVD case in 2022, share prices slumped as the supply chain froze until President Biden enacted a two-year moratorium on retroactive tariffs. This moratorium ends at the close of this month and we doubt that Biden, in an election year, is willing to introduce a new moratorium that will help Chinese manufacturers and harm domestic producers.

The obvious winners from the new AD/CVD case are FSLR and other smaller domestic producers of solar panels. For everyone else in this industry, including the solar developers, the impact is negative. This is especially true for Chinese manufacturers, which typically sell less than 10% of their total volumes in the US, but due to the high US panel prices derive up to 30% of their total revenues from the country.

While the AD/CVD petition clearly helped to boost FSLR’s stock price during the month, the other solar stocks most likely went along for the AI ride. Surprisingly, even several Chinese solar manufacturers, collectively accounting for around 10% of the TAN index, saw gains of about 20% in May despite the new AD/CVD case. This could be attributed to speculations that the Chinese government might take steps to address the significant overcapacity in China's solar manufacturing industry. In the last 12-18 months, panel prices have dropped by almost 50% and are in many instances selling below costs.

We discussed the increased power demand from AI data centers (DCs) in our March-24 report “Roadblocks on the AI highway”. As the hyperscalers (large tech companies) constructing large DCs have either 100% renewable energy targets or net zero commitments, the incremental power will have to be derived from renewable energy. Even if the hyperscalers initially should use gas or connect to grids partly run on fossil fuels, they will need to offset the additional carbon by investing in more renewable energy. As solar is carbon-free and has the lowest cost of levelized energy, this is an obvious tailwind for the solar industry.

Strengthening this view, the Electric Reliability Council of Texas (ERCOT) in its latest Capacity, Demand, and Reserves report substantially increased the expected average load growth for Texas for 2025-2029. The main reason was the many new manufacturing facilities and DCs planned in Texas. However, BNP Paribas calculates that this load requirement could boost average annual demand for new solar PV installations by more than 80% to 26GW vs their previous estimate of 14GW p.a. If the rest of the US should follow Texas’ upgrade, BNP estimates that US annual average demand for 2025-2029 would be 70GW instead of 57GW, more than 20% higher than last year’s estimate.

Surely, all signs are pointing toward a solar industry where growth will explode? Over time, we believe the outlook appear bright, however the near-term prospects are more uncertain. The challenge for the solar industry is not a lack of demand, but the bottlenecks are rather grid connections, electrical equipment, permitting and available labour. For instance, demand for grid connection has for years overwhelmed grid capacity and Berkely Labs, a national research laboratory, estimated that 2,600GW of power generation and storage assets were waiting for interconnection approval at the end of 2023. This is about twice the power of all current US power plants on a name plate capacity basis.

Significant steps are taken to clear up the grid bottlenecks though. During May, three separate but related transmission reforms were released by the US federal government. First, the US Department of Energy (DOE) proposed ten new “national interest electric transmission corridors” which allows the federal government to accelerate projects in areas where consumers are harmed by the lack of transmission. Barely a week later, the Federal Energy Regulatory Commission (FERC) released Order 1920 and 1977 which both aim to improve permitting times for construction of the transmission grid with new rules around long term planning and cost allocation between states. Together this is a significant development and has been touted by some as the most important energy legislation since the Inflation Reduction Act (IRA).

While there is no immediate impact in the growth of utility scale solar installations, the effect of AI power demand is already visible in higher power purchase agreements (PPAs) for solar installations post 2026. This is obviously good news for renewable energy developers and FSLR is again a clear winner. The company had already sold its US capacity for the next three years but will now see increased demand for its post 2027 capacity. More demand combined with less competition due to AD/CVD means increased pricing power, and FSLR has already signaled that panel prices for post 2027 capacity is 15-20% higher than today’s prices vs the expectation only a few months ago that prices would decline by 15-20%.

The outlook for the rest of the utility scale solar sector is more uncertain. Key questions remain: How many projects will be delayed due to AD/CVD uncertainty? How quickly can the many bottlenecks be resolved, and will the AI driven demand boost last? Although we expect near-term fundamentals to be soft, we acknowledge that the strong May performance might signal that investors are willing to look beyond some weak quarters into a stronger 2025 and 2026.

We continue to closely monitor developments in the solar space but remain selective in our investments. Instead, we prefer companies that are actively involved in addressing grid capacity bottlenecks, as they are likely to play a key role in the growth in both solar, AI and many other industries.

FUND PERFORMANCE – STRONG ABSOLUTE PERFORMANCE

The absolute performance in May was a solid 4.7% (I USD share class) with most of the themes contributing positively although the fund underperformed the most comparable renewable indices. All but two of the net long investment themes were profitable, while the two pure short themes in hydrogen were both loss-making as should be expected in a strong market rally. Some themes were impacted by short squeezes, and one was even briefly impacted by the meme-stock rally mid-month.

The top performing theme, contributing 3.1% to NAV, was “US Renewable Development” which consists of the two leading renewable energy developers Nextera Energy (NEE) and AES. As we discussed in detail in the March-24 report, both companies are very well positioned to capitalize on the surge in power demand from AI data centers. Even though we are concerned that potential tariffs from AD/CVD might hamper their investment plans, both companies downplay the impact as they have secured solar panels for 2024 and expect adequate domestic panel supply from 2026. The regulatory environment in the US has always been challenging, and we believe few companies are better equipped to maneuver its intrinsicses than these two developers. In fact, the latest uncertainty from AD/CVD is likely to make NEE and AES even more attractive counterparts for large tech companies with significant investment budgets and an urgent need for reliable power.

The second-best theme was “Solar” which added 2.5% to NAV, mainly due to the strong performance of First Solar (FSLR). Excluding this position, the theme was only slightly net long since, as discussed above, we are not convinced about a sustained near-term rally in the solar space. We remain optimistic about FSLR, although we have slightly reduced the position after the stream of positive news flow over the last month resulting in a more than 50% boost to the share price. It still remains one of our largest positions though.

Third best performer was “Grid Equipment” contributing 1.3% to NAV, while the four grid related themes in aggregate added a combined 2%. Year to date, this thematic has been the strongest contributor to NAV by far and we expect this to continue as the tailwinds are only growing for grid related companies.

The worst performing theme in May was “EU Hydrogen” which deducted 3.7% from NAV. Its US counterpart lost only 0.3% as we reduced risk in this theme last month deeming short squeeze risk to be higher in the US than in Europe. This was only partly correct as some of the European names rallied even more, driven mainly by momentum and high short interest, in our view.

We have discussed our negative view on hydrogen equities in several monthly reports and in more detail in the April-24 report. The gist of our argument is that green hydrogen will not be competitive with fossil fuel derived grey hydrogen without significantly lower electricity prices (which account for about 80% of cost), higher carbon taxes on grey hydrogen and/or substantial subsidies for green hydrogen.

With the increasing electricity demand from power for data centers and electrification of industry, heating, and vehicles, we do not foresee significantly lower electricity prices in the coming years. Higher carbon taxes on fossil fuels would be a neat solution, but politically difficult and very time consuming to introduce. The last option for the optimists is subsidies. However, we believe even politicians are realizing the immense cost involved in bridging the cost gap between grey and green hydrogen. As the political wind in Europe has probably shifted to the right, we expect EU’s ambition for hydrogen to be scaled back or at least be pushed to the right.

Sincerely

Vidar Kalvoy & Joel Etzler

Past performance is not a guarantee of future returns. The price of the investment may go up or down and an investor may not get back the amount originally invested.

- Portföljförvaltare och grundare av fonden Coeli Energy Opportunities.

- Mer än 15 års erfarenhet av investeringar från både publika och private equity-sidan.

- Förvaltade fonden Coeli Energy Transition under perioden 2019 - 2023.

- Spenderade sex år på Horizon Asset i London, en marknadsneutral hedgefond.

- Började arbeta tillsammans med Vidar Kalvoy 2012.

- Fem år inom Private Equity på Morgan Stanley.

- Startade sin investeringskarriär inom tekniksektorn på Sweden Robur i Stockholm 2006.

- Utbildad Civilingenjör från Kungliga Tekniska Högskolan.

- Portföljförvaltare och grundare av Coeli Energy Opportunities-fonden.

- Förvaltat aktier inom energisektorn sedan 2006 och har mer än 20 års erfarenhet från portföljförvaltning och aktieanalys.

- Förvaltade fonden Coeli Energy Transition under perioden 2019 - 2023.

- Ansvarig för energiinvesteringarna på Horizon Asset i London under 9 år, en marknadsneutral hedgefond.

- Erfarenhet från energiinvesteringar på MKM Longboat i London och aktieanalys inom teknologisektorn i Frankfurt och Oslo.

- MBA från IESE i Barcelona och Civilekonom från Norges Handelshögskola.

- Innan han började arbeta inom finans var han löjtnant i norska marinen.

IMPORTANT INFORMATION. This is a marketing communication.

Before making any final investment decisions, please refer to the prospectus of Coeli SICAV II, its Annual Report, and the KID of the relevant Sub-Fund. Relevant information documents are available in English at coeli.com. A summary of investor rights will be available at https://coeli.se/finansiell-och-legal-information/. Past performance is not a guarantee of future returns. The price of the investment may go up or down and an investor may not get back the amount originally invested. Please note that the management company of the fund may decide to terminate the arrangements made for the marketing of the fund in one or multiple jurisdictions in which there exists arrangements for marketing.