NOTE: We are not owners of Take-Two, and these comments should not be considered as investment advice in any form. These are nothing more than my considerations and high-level thinking. The thoughts and opinions expressed here are strictly my own personal view.

I love this job.

For well over a decade now, I have been able to travel all over the globe, meeting some of the world’s best business leaders (and probably some of the worst, too, when I think about it, but let’s skip that part), and I am grateful each day that I have this job.

One of our latest meetings in New York was with a company that has been high on my wish list for a long time, as I have grown up with the products they make. That company is Take-Two Interactive Software, the owner of some of the best gaming franchises ever made, including Grand Theft Auto (GTA), Red Dead Redemption, NBA 2K League, and my own personal childhood favourite, Sid Meier's Civilization. In fact, five of the top-selling franchises (including GTA) constitute more than 80% of Take-Two’s revenues.

Take-Two (T2) owns these gaming franchises through a selection of studios, such as Rockstar Games, 2K, etc, and the company has around 5,000 developers in different parts of the world. GTA, for example, was developed by Rockstar North, which has its head office in Edinburgh, UK.

Our meeting with Take-Two’s CFO Lainie Goldstein

This is an attractive industry

The gaming industry is highly attractive to investors. The global video game market achieved a 19% five-year CAGR in 2020 (according to T2’s annual report), and many game developers are highly profitable. Look at T2 as an example: it has had an operating margin of some 22% in 2021 – a very solid number.

Investing in the gaming industry can be tricky, though

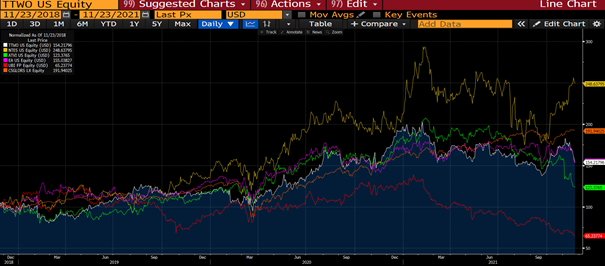

We have been analysing the gaming sector for many years now and have previously invested in Chinese gaming company Netease, whose HQ in Hangzhou, China, we visited in March 2016. The problem with the sector from an investment standpoint is that you never know which game is going to be a winner. The chart below shows the share price development of several of the world’s leading game developers over the last three years:

- Take-Two (Grand Theft Auto)

- Netease (Fantasy Westward Journey)

- Activision Blizzard (World of Warcraft)

- Electronic Arts (The Sims, Star Wars)

- Ubisoft (Assassin's Creed)

The orange line in the chart is our fund, Coeli Global Select. As you can see, on a three-year basis, only one of these companies’ share prices has outperformed the fund, that being Netease.

Source: Bloomberg

We have gone down the hardware route

A few years ago, we came to the conclusion that there are two ways to invest in the growing gaming sector:

- As it is so hard to predict the winner, buy them all as a sector, and assign an equal value to each name. Rebalance this every year.

- Buy what all gamers need to play the games: graphic cards.

That thought process led to us investing in NVIDIA a few years ago. Its share price performance compared with that of the game developers is obvious from the following graph (NVIDIA being the blue line at the top).

Source: Bloomberg

Take-Two could be a very good investment over the next two to three years, however

That said, I am still very interested in T2 as an investment over the next couple of years, the main reason being that GTA VI should soon be released.

Grand Theft Auto V (the latest version of this epic game) was released in 2013. Yes, eight years ago. It has been updated, of course, but fans are clamouring for the next release. There are always endless rumours about when the next version will be released (I personally thought it would be released together with the PlayStation 5, but I was so wrong), and we did not get any new information from the CFO during our meeting, but it must be released sooner than later.

The question is, of course, when will that be? Followed by, how big could it become? Well, according to Wikipedia, some 140 million people have played GTA. If we round that out and assume that 70 million copies will be sold in the six months following the game’s release and assume a selling price of USD 90 (including in-game-purchases), that means revenue of USD 6.3bn. There will be distribution fees to third-party digital delivery platforms, such as Microsoft's Xbox Live, PlayStation Network, Steam, Epic, etc, and these fees will perhaps reduce that USD 6.3bn by roughly 25% plus some USD 200 mln in marketing and advertisement costs will also be needed. Furthermore, T2 has some USD 500m in capitalized software development costs (ie the amount of money it has invested in developing new games, perhaps two-thirds of which relates to GTA, ie USD ~350m) that will be activated when GTA VI is released. All in all, my best guess is that T2 will end up at something like USD 4bn in profit from the new release (USD 6.3bn - (USD 6.3bn*25% of distribution fees) - USD 350m in activated development costs -200 mln marketing spend = USD 4.2bn)

T2 has a market capitalization of USD 18bn, so USD 4bn is a vast number in that context, even for this giant of a company. This profit windfall, combined with a lot of interest generated in the company, definitively has the potential to drive the share price higher (all else being equal). The company expects to deliver approximately 20 titles per year for the next several years, and this armada of titles will help to reduce its reliance of one individual success story, something that could boost the share price even further.

The impression we took away of CFO Lainie Goldstein was of calm and knowledgeable professionalism. This is an amazing company that we would be very happy to one day be invested in. My childhood self would be over the moon, to say the least.

Viktig information. Denna information är avsedd som marknadsföring. Fondens prospekt, faktablad och årsberättelse finns att tillgå på coeli.se och rekommenderas att läsas innan beslut att investera i den aktuella fonden. Prospektet och årsberättelsen finns på engelska och fondens faktablad finns bland annat på svenska och engelska. En sammanfattning av dina rättigheter som investerare i fonden finns tillgängligt på https://coeli.se/finansiell-och-legal-information/

Historisk avkastning är ingen garanti för framtida avkastning. En investering i fonder kan både öka och minska i värde. Det är inte säkert att du får tillbaka det investerade kapitalet.