For those of you who don’t know me and are wondering why I am writing this in English, my name is Christopher Wright and I am a New Investment Analyst, born in New Zealand, who started with Coeli Global in October 2022.

Prior to working at Coeli Global, I worked for 5 years at a Top New Zealand Small Cap Asset Manager (Pie Funds Ltd) and more recently at a highly regarded German Pan-European Small Cap Asset Manager based in Munich (Gallo Fonds GmbH).

I am learning Swedish and I plan on writing more of my blogs in Swedish when I can.

Christopher Wright Analyst at Coeli Global, Aditi Patel Analyst at ICICI, Kedar Shirali Vice President and Global Head – Investor & Analyst Relations at Tata Consultancy Services and Henrik Milton Portfolio Manager at Coeli Global.

Who are the Tata Group and what do they do?

Recently Henrik Milton and I took a week long trip to India to meet with a number of current & potential Portfolio Holdings.

On the ground research is incredibly important to us, we spent the week meeting 12 companies and chatting with other investors to try and “turn over as many rocks” as possible for you, our investors.

For those of you who are unfamiliar with the Tata Family and their incredible business success, the Tata Group was formed in 1868 and is India’s largest conglomerate. Many refer to the founder (Jamsetji Tata) as the “father of Indian Industry”. The group’s annual revenue for FY21/22 was ~$128bn USD, spread across 29 publicly listed Tata Companies, with a market capitalisation of $311bn USD (March 2022).

Tata Consultancy, an in-person meeting with an Indian Champion!

Our focus at Coeli Global is searching the earth for the best businesses and we were lucky enough to find one in Tata Consultancy ($147bn USD Market Cap) at their offices in Mumbai.

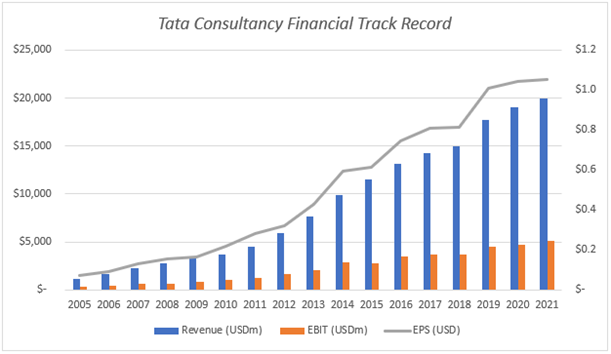

As you can see from the chart below, Tata Consultancy has an incredible financial track record, and with industry leading margins and revenue growth, is considered by many Industry Analysts as the Worlds Best Outsourcing Consultant.

Källa: Catena / Coeli Global

Outsourcing, a “boring” Industry with exciting returns!

Many westerners often are unaware of the enormous outsourcing industry, where large western corporate firms outsource large chunks of their “Run the Business” functions to Indian and foreign competitors.

As large banks, global industrial firms, media titans and leading healthcare companies have grown over time, they often look to Highly Trusted Partners such as TCS to run large internal chunks of their business. As TCS is in many cases, running the internal functions of these globally leading businesses and building software/digital solutions for their critical infrastructure, the amount of trust that Fortune 500 companies have in TCS is immense.

With a “labour arbitrage” available in India (replace costly western employees with access to Indias vast digitally savvy talent pool), companies have been increasingly looking to companies such as TCS to take over major chunks of their “Run the Business” function, while also increasingly relying on them to complete very complex digital transformation projects.

This isn’t low end call centre work, this is building hyper complex software solutions for International Stock Exchanges and banks to run on. Without TCS’ solutions, most likely we wouldn’t be able to access our money or buy a stock anywhere!

An underappreciated part of TCS’ business model is the “Build once, Sell Many” software development work they do for many clients. When TCS builds a software solution for a customer, they keep the IP rights and often then sell this to other clients who are in need of a similar solution, enabling them to have a highly profitable and growing SaaS software arm within their business.

Financial Performance

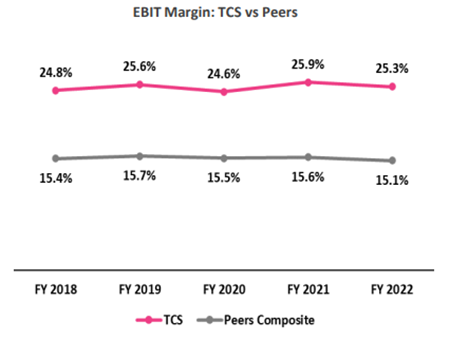

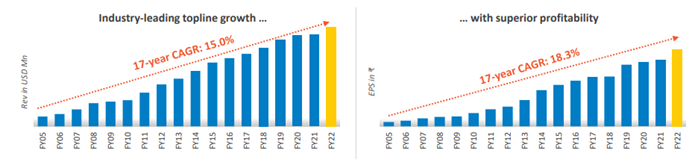

As we’ve just seen, TCS has a world class financial track record which has propelled it to be the worlds second most valuable IT company (after Accenture). TCS has grown it’s revenue at 15% CAGR (2005-2022) at an industry leading ~27-28% EBITDA margin. This business gushes cash and requires very little capital to grow. As part of it’s “Secret Sauce”, which enables it to generate industry leading returns, TCS pioneered standardised software production which results in fewer errors, easier compatibility and a more consistent product.

Just like me when I order a Big Mac In Stockholm or Mumbai, TCS customers love a consistent, quality and verifiable product. speaking with management, TCS has no shortage of talent (this is primarily a business where you need to add people to grow), and last year hired 103,000 people. Management believe there is a strong and available talent pool with a customer base who are constantly increasing outsourcing & digital change budgets and handing over more and more of their critical business functions.

A “nice to have” element with this business is that, as TCS grows, their software business which is “hidden” within it’s segments should grow considerably faster than the consulting business and could easily go from ~5% to 20% of their business over time. Further to this, management have commented that the Next 5 years will be BETTER than the previous 5 Years in terms of growth! And with their business mix going from ~80% outsource / 20% digital transformation -> 70% outsource / 30% digital transformation, we believe there is a bright future ahead.

Source: Tata Consultancy Services Investor presentation 2022 and Coeli Global analysis.

Note that Coeli Global does not have holdings in Tata Consultancy Services.

Viktig information. Denna information är avsedd som marknadsföring. Fondens prospekt, faktablad och årsberättelse finns att tillgå på coeli.se och rekommenderas att läsas innan beslut att investera i den aktuella fonden. Prospektet och årsberättelsen finns på engelska och fondens faktablad finns bland annat på svenska och engelska. En sammanfattning av dina rättigheter som investerare i fonden finns tillgängligt på https://coeli.se/finansiell-och-legal-information/

Historisk avkastning är ingen garanti för framtida avkastning. En investering i fonder kan både öka och minska i värde. Det är inte säkert att du får tillbaka det investerade kapitalet.