This material is marketing communication.

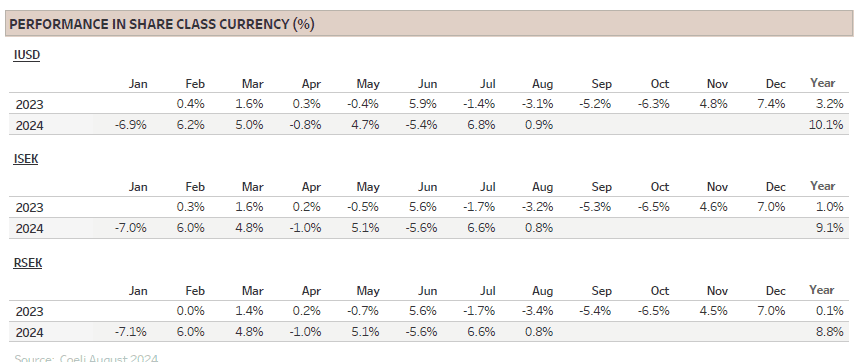

Note that the information below describes the share class (I USD), which is a share class reserved for institutional investors. Investments in other share classes generally have other conditions regarding, among other things, fees, which affects the share class return. The information below regarding returns therefore differs from the returns in other share classes.

Past performance is not a guarantee of future returns. The price of the investment may go up or down and an investor may not get back the amount originally invested.

1) Share Class I USD

Performance for other share classes towards the end of the report.

FUND MANAGER COMMENTARY

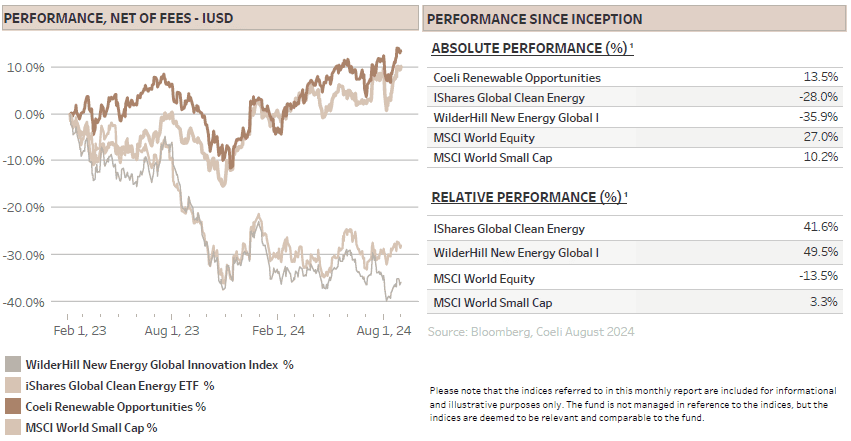

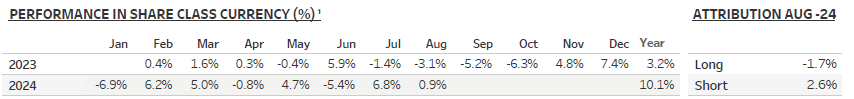

The Coeli Renewable Opportunities fund gained 0.9% net of fees and expenses in August (I USD share class). It is up 10.1% this year and has increased by 13.5% since the inception in February 2023.

The fund increased its outperformance to the Wilderhill New Energy Global index (NEX) by 3.1%, but lagged the other most comparable index, the iShares Global Clean Energy (ICLN), by 0.1%. Still, the year-to-date outperformance is solid at 26% and 18%, respectively, while the fund is ahead by 50% and 42% since the inception in February last year.

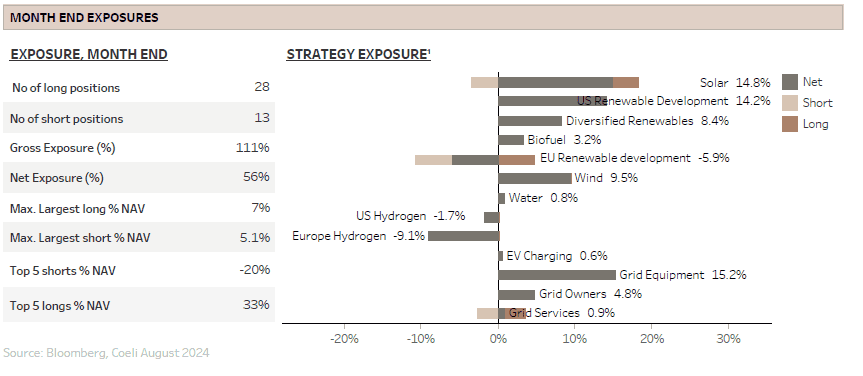

Performance was mixed without any standout winning or losing themes. The two pure short hydrogen themes led the winners as 8 out of 13 themes were up on the month. The ‘Solar’ theme also contributed positively due to the increased exposure to residential solar and despite the continued weak performance in utility scale solar. The largest losing theme was ‘Diversified Renewables’ which lost 1.4% of NAV after a weak Q2 report from Chart Industries (GTLS).

Long attribution was -1.7% while shorts contributed by 2.6%. Net exposure was in the mid 40% early in August but ended the month at 56%. Gross exposure was in the 110-120% range most of the month and ended at 111%.

MARKET COMMENT – VOLATILITY IS BACK

Triggered by recession fears, August started with a massive sell-off where the S&P 500 lost more than 6% in the first three trading days and the volatility index (VIX) spiked to levels only seen in the financial crisis and during Covid. Nevertheless, as overall economic activity numbers did not support the hard landing scenario, the VIX quickly receded while the S&P 500 recovered and ended the month up 2.3%, less than 0.5% below the all-time high in July.

The tech heavy Nasdaq index dropped by 8% in the initial sell-off but rose 1% during the month. It was still more than 5% below its all-time high at month end, maybe a sign that tech stocks’ outperformance has peaked. On the other hand, the small cap index, the Russel 2000, ‘only’ lost 10% in the first three-day sell-off, which is surprisingly robust considering the high beta of small caps and their strong outperformance in July. Russel 2000 closed August down 1.6% and is still 10% below its all-time high from November 2021, which coincidentally was the time the market started to shift inflation and interest rate expectations higher.

FED chairman Powell’s speech at Jackson Hole also helped the stock market to recover in August. Although inflation is not yet down to FED’s target, Powell confirmed that the focus has shifted from inflation to the weakening labour market. This cemented the expectation of FED cuts commencing in September. The only question is if the FED will do a single 25bps cut or a double at 50bps. The bond market put the probability of a double cut at 30% at month end with exactly four cuts by the end of the year. However, at the time of writing, the market is pricing a 25% chance of double cut in September and a 50% chance of five cuts in total by the end of the year. Clearly, the bond market has become more concerned about a recession, which has also caused the equity market to sell off in early September.

RENEWABLE ENERGY – BINARY RISK IN THE RESIDENTIAL SOLAR MARKET

Few industries are as interest rate sensitive as the broad renewable energy sector. Most companies are either capital intensive with high financial leverage or the positive cash flows are years into the future. In many cases, both features apply. Although there are other factors at play, there is little doubt that the spike in interest rates is one of the reasons for the massive underperformance of renewable energy stocks over the last years.

In our opinion, maybe the most interest rate sensitive sub-sector in renewables is residential solar where companies sell and install roof top solar systems for households. The finance companies, often referred to as solar service companies, have highly capital-intensive business models. They often outsource the installation job to third parties but finance the solar systems for the buyers through a 10-to-20-year lease or a loan. As interest rates rose, it became more expensive to finance new sales, and more importantly, the value of the existing lease and loan books and net present value of future cash flows declined. In addition, higher interest rates generally lead to less demand for large residential investments like roof top solar systems, which often cost about USD 20 000-30 000.

The higher rates were a triple whammy and the share price of the two largest players, Sunrun (RUN) and Sunnova (NOVA) dropped by 80-90% from late 2021 to the bottom in April this year. The third largest solar service company with a slightly different business model, Sunpower (SPWR), recently filed for bankruptcy.

However, with interest rates about to be cut, there is little doubt that these companies should get some tailwind, and to a certain degree, this is already reflected in the share price as RUN has almost doubled and NOVA has tripled since the bottom in April.

Moreover, there are additional positive factors to consider. First, the guidelines for domestic content tax credits that were detailed in late April exceeded expectations. In total, the installers can obtain a total tax credit in excess of 45%, about 10 percentage points above what the market expected earlier this year. This requires that it is a lease sale with a certain percentage of US manufactured components. As it is relatively easy to monetize the tax credits, this will help them stay on top of repayments of corporate loans and reduce the risk of equity dilution to fund future growth.

Second, as we have noted in several previous monthly reports, retail electricity prices have increased and are likely to continue climbing over the next years as new generation and distribution capacity are needed. As electricity prices rise, the payback time for buyers of residential solar systems will decrease and demand will increase. The potential for residential solar in the US is still vast as penetration is only about 4-5%, compared to about 30% in countries like Germany and Australia.

Third, post-COVID, the cost of equipment and labour surged, further dampening demand for residential solar systems. Today, there are an abundance of small installers fighting for jobs while the cost of solar panels and inverters are declining, although not as much as in international markets.

Fourth, the downturn for the installers coincided with changes to net metering rules in California, by far the largest residential solar market in the US. The new rules sought to incentivise solar systems to include storage, which make sense given the abundance of electricity generation during the day when the sun is shining. Nevertheless, the anticipation of the new regulation pulled demand forward and later led to a significant drop in demand as the market adjusted to less favourable metering rules and higher total costs due to the addition of storage. However, the new metering rules were introduced during the spring of last year and it is expected that California will start growing again next year.

Finally, it also helps the two incumbents, RUN and NOVA, that their largest competitor, SPWR, went bankrupt. Not only is there less competition for signing up residential buyers, but it also improves negotiation power versus the many installers scrambling to keep their workforce employed.

However, despite the favourable conditions, several potential headwinds could offset the tailwinds. First, if interest rate cuts coincide with a recession, the benefits of lower base rates will be diminished as credit spreads widen. Additionally, economic uncertainty during a recession typically causes consumers to postpone large investments, such as rooftop solar systems. As a result, highly leveraged companies generally struggle during recessions, which likely puts further pressure on share prices.

Second, the political risks remain significant. As we have discussed in many previous monthly reports, we doubt that the Inflation Reduction Act (IRA) will be revoked even in a red sweep scenario where former president Trump wins the White House and the republicans’ control both chambers of Congress. Still, there might be smaller changes to the IRA, especially since residential solar does not directly create U.S. manufacturing jobs—a priority for the Republicans. While the IRA is secure if the Democrats retain control of at least one chamber, a Trump-led administration could introduce challenges, such as making it more strident to qualify for domestic content adders. That said, this political risk is widely acknowledged by the market and since the election is still a toss-up, there is already a significant risk premium baked into the share price of RUN and NOVA. This also means there is significant further upside if Vice President Harris should win the election.

Third, the solar service companies’ business model is complex and many question the model and the ability to generate cash when growing the customer base at elevated levels. This is an obstacle many investors face when analysing the financials. However, the introduction of domestic content adders has reduced some of those concerns, but one of the key ideas behind the Inflation Reduction Act is that tax credits will result in more competition and eventually lower prices for end customers. The industry should expect to gradually transfer the value of the credits to the end buyers of roof top solar systems.

There are already signs of increasing competition as leasing companies are entering the business post the publication of the IRA guidelines. Although this in line with our expectation, we note that the incumbents have scale advantages with hundreds of thousands of customers and established service and performance records with thousands of dealers and installers. We believe it will be hard to match this in the short term, even for well-capitalized new entrants. Interestingly, concerns about increased competition are emerging just months after the market questioned the viability of the business model. The fact that new entrants are now pursuing this space suggests to us that they see its long-term potential.

In summary, we like the business model and believe RUN and NOVA will create positive cash flows and value for their shareholders. Although their stock prices have surged 100% and 200% in recent months, respectively, there is still significant upside if rate cuts occur without a recession and if Harris wins the presidency. On the other hand, the downside risks remain substantial in the short term if Trump wins the election or if the U.S. economy slips into a recession. The risk outlook is binary. Although we have increased our exposure over recent months, we have carefully sized the positions and are closely monitoring developments.

FUND PERFORMANCE – MIXED PERFORMANCE IN AUGUST

Into August, the fund reduced net exposure from the high 50% during most of July to high 40% at the end of the month as we worried about profit taking from record high levels into a low liquidity trading environment in August. This worked well as the fund lost only 4.5% in the first three days versus 6% for the S&P 500 and 9% for the Wilderhill New Energy Index (NEX). Despite the large absolute drawdown at the start of the month, all but 3 of the 13 themes ended within the -0.4% to 0.4% range.

The best performing themes in August were EU and US Hydrogen, which contributed a combined 1.6% to NAV. Both themes are pure short themes indicating our skepticism to most green hydrogen business models. We have discussed this in many previous monthly reports, but in depth in the April- 24 report “IS THERE HOPE ON THE HORIZON FOR HYDROGEN?”. The gist is that green hydrogen’s inefficiencies as an energy carrier make it too expensive to produce. Despite the already substantial capex subsidies, massive further financial assistance would be required to incentivize off-takers to sign contracts for significant volumes of green hydrogen. In the current political environment, this is unlikely and instead projects are being postponed and delayed. The order intake for electrolyser companies remains dismal and revenue estimates will continue to be ratcheted downwards. As soon as the capital raised during the hype three years ago is burned through, we believe the focus will shift to raising new capital at even lower share prices.

The Solar theme contributed 0.4% to NAV, but the different sub-segments had very varied performance. On the one hand, the increased exposure to residential solar companies NOVA and RUN significantly aided performance as we alluded to in the thematic part above. It also helped that we exited our long held short in SPWR as the stock is in Chapter 11 and basically down 100% since we entered the position. We have also exited the long-held short in Maxeon Solar (MAXN) as the share price is equally decimated. Although the company is not bankrupt, existing shareholders will effectively be wiped out by a massive rights issue towards a Chinese company.

On the other hand, the long-held investments in utility scale solar continues to be a drag on performance despite reducing the positions significantly over the last months. With hindsight, we should have been even more aggressive, but we were blinded by the strong underlying demand for utility scale solar while we underestimated the risk of project delays. After exiting our position in Array Technologies (ARRY) in February, we discussed in the Feb-24 monthly report the many bottlenecks holding back demand growth, especially the lack of grid interconnection and permitting queues.

In our May-24 monthly report “OPPORTUNITIES AND CHALLENGES IN US SOLAR” we also discussed the new risk of retroactive tariffs on solar panels which we believe could continue to cause project delays. We also elaborated on First Solar (FSLR), the only utility scale solar stock that worked in our portfolio in August as it is insulated from most of the issues faced by the other utility scale companies. While we do believe the different bottlenecks will over time be sorted out and probably causing significant pent-up demand, timing is everything and we remain cautious for now.

The only theme down more than 0.2% of NAV in August was “Diversified Renewables” which lost 1.4%. This theme consists mainly of Chart Industries (GTLS), a long held favourite energy transition company. It is again our largest position and we have discussed the company in many previous monthly reports. The essence is that company is undervalued by the market due to the high leverage following a large acquisition almost two years ago. Moreover, the market is not yet giving the company credit for reducing earnings cyclicality through an increasing revenue share from after-market activities and improved growth outlook after the acquisition. Nevertheless, although we like the company, its communication on forward expectations has room for improvement. The stock sold of more than 30% after the company missed Q2 EBITDA by 5% and lowered the mid-point of full year EBITDA guidance by 10%. More importantly, the full-year free cash flow guidance was lowered by 27%. Although disappointing to see a miss on these important metrics, the stock is continuing to reduce net debt and although it will hit the target leverage ratio a quarter later than expected, we are still confident that it will be reached. Fortunately, we sold a third of our position in late July into the Q2 earnings report in early August but added it all back and then some after the sell-off.

Sincerely

Vidar Kalvoy & Joel Etzler

Past performance is not a guarantee of future returns. The price of the investment may go up or down and an investor may not get back the amount originally invested.

- Portföljförvaltare och grundare av fonden Coeli Energy Opportunities.

- Mer än 15 års erfarenhet av investeringar från både publika och private equity-sidan.

- Förvaltade fonden Coeli Energy Transition under perioden 2019 - 2023.

- Spenderade sex år på Horizon Asset i London, en marknadsneutral hedgefond.

- Började arbeta tillsammans med Vidar Kalvoy 2012.

- Fem år inom Private Equity på Morgan Stanley.

- Startade sin investeringskarriär inom tekniksektorn på Sweden Robur i Stockholm 2006.

- Utbildad Civilingenjör från Kungliga Tekniska Högskolan.

- Portföljförvaltare och grundare av Coeli Energy Opportunities-fonden.

- Förvaltat aktier inom energisektorn sedan 2006 och har mer än 20 års erfarenhet från portföljförvaltning och aktieanalys.

- Förvaltade fonden Coeli Energy Transition under perioden 2019 - 2023.

- Ansvarig för energiinvesteringarna på Horizon Asset i London under 9 år, en marknadsneutral hedgefond.

- Erfarenhet från energiinvesteringar på MKM Longboat i London och aktieanalys inom teknologisektorn i Frankfurt och Oslo.

- MBA från IESE i Barcelona och Civilekonom från Norges Handelshögskola.

- Innan han började arbeta inom finans var han löjtnant i norska marinen.

IMPORTANT INFORMATION. This is a marketing communication.

Before making any final investment decisions, please refer to the prospectus of Coeli SICAV II, its Annual Report, and the KID of the relevant Sub-Fund. Relevant information documents are available in English at coeli.com. A summary of investor rights will be available at https://coeli.se/finansiell-och-legal-information/. Past performance is not a guarantee of future returns. The price of the investment may go up or down and an investor may not get back the amount originally invested. Please note that the management company of the fund may decide to terminate the arrangements made for the marketing of the fund in one or multiple jurisdictions in which there exists arrangements for marketing.