Experternas syn på investeringsåret 2025

Missa inte Coelis exklusiva guide med marknadsanalyser, investeringscase och strategier för att optimera din portfölj. Ta del av våra experters insikter och investera med självförtroende.

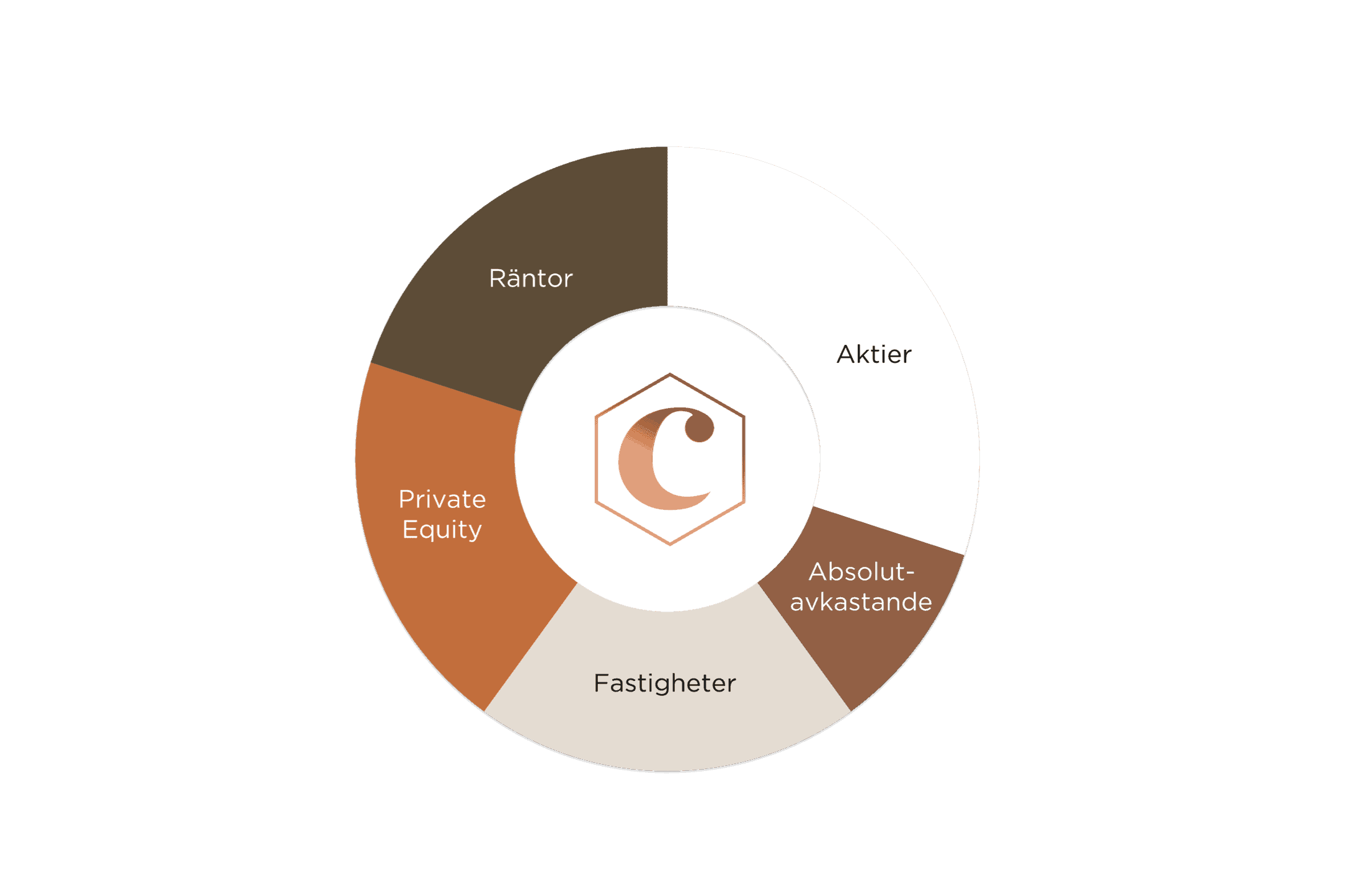

Coelis investeringsfilosofi genomsyras av aktiva och tydliga ställningstaganden som baseras på djup analys och effektiv portföljoptimering. Genom en bred diversifiering inom högavkastande tillgångsslag strävar vi efter att prestera bättre än marknaden och skapa en hög riskjusterad avkastning över tid till våra kunder och partners.

Genom Coelis partnerskapsmodell attraherar vi erkänt skickliga förvaltare och investeringsteam vilket är grunden i vårt värdeskapande.