This material is marketing communication.

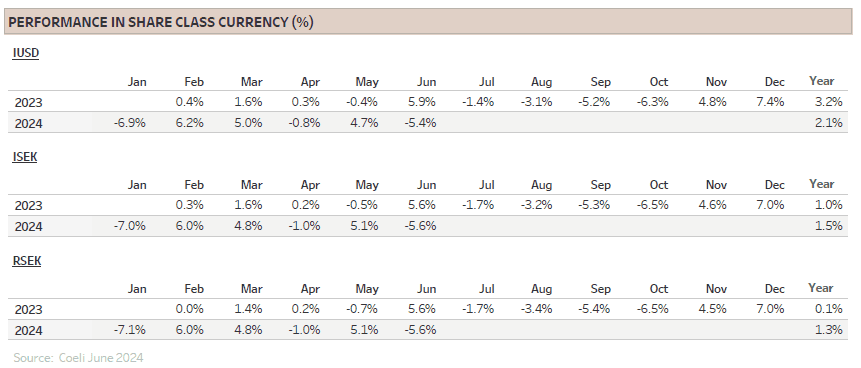

Note that the information below describes the share class (I USD), which is a share class reserved for institutional investors. Investments in other share classes generally have other conditions regarding, among other things, fees, which affects the share class return. The information below regarding returns therefore differs from the returns in other share classes.

Past performance is not a guarantee of future returns. The price of the investment may go up or down and an investor may not get back the amount originally invested.

1) Share Class I USD

Performance for other share classes towards the end of the report.

FUND MANAGER COMMENTARY

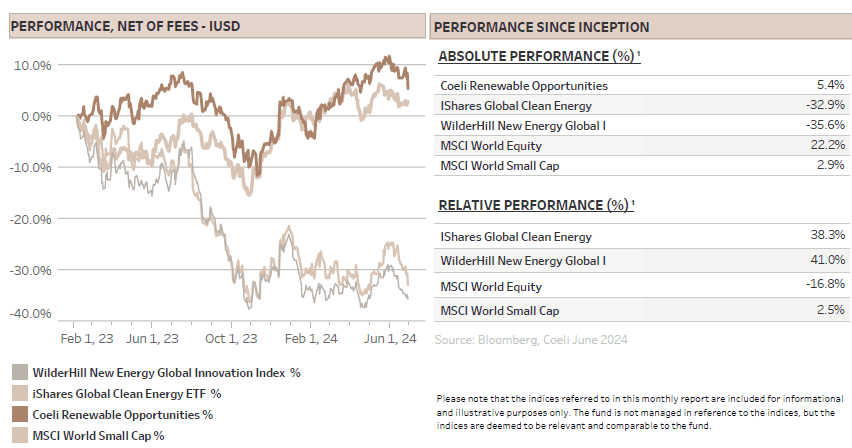

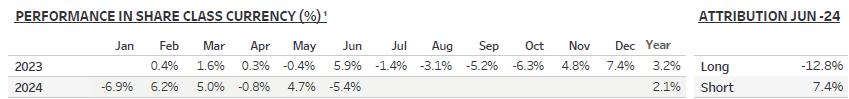

The Coeli Renewable Opportunities fund lost 5.4% net of fees and expenses in June (I USD share class). It is up 2.1% this year and has increased 5.4% since the inception on February 6, 2023.

The fund grew its outperformance to the two most comparable indices, the Wilderhill New Energy Global index (NEX) and the iShares Global Clean Energy (ICLN), by 3.6% and 5.0%, respectively. The year-to-date outperformance is 16-18% and since inception, the fund is ahead by 38-41%.

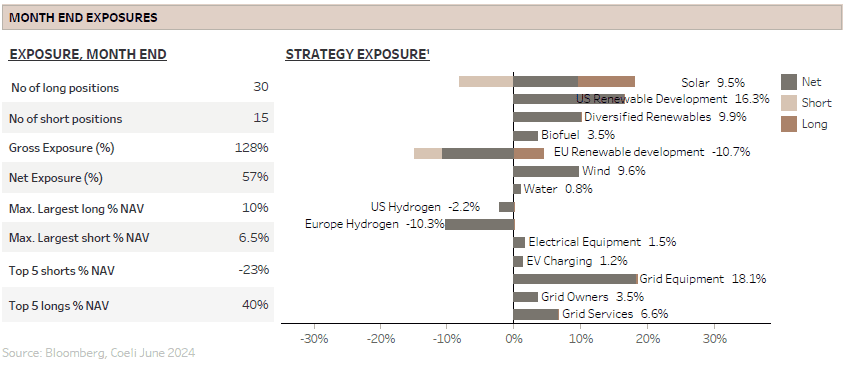

In addition to some cooling down of the hype around powering data centers for artificial intelligence (AI) and a reversal after the strong May performance, the renewable energy space was hit by increased political risk in both Europe and the US. All themes but the two short hydrogen themes were down in June. They added a combined 3.9% to NAV following similar sized losses in May, a month with significant short squeezes.

The worst performing themes in June were “US Renewable Development”, “Wind” and “Solar”, which combined deducted 6.3% from NAV. In general, the largest losing stocks were the best performers in May, all impacted by increased political risk. We dig deeper into this topic later in the report.

Contribution from the long side was negative at 12.8% and the shorts made 7.4%. Net exposure was in the 50% range during the month and closed at 57%, while gross exposure was in the 130% range but ended the month at 128%.

MARKET COMMENT – MEGACAP TECH LEADS THE MARKETS HIGHER, AGAIN

The S&P 500 rose 3.5% in June, setting another seven all-time high records during the month. The index is up 14.5% and has made as many as 30 all-time highs in the first half of the year. Unfortunately, the strong June performance was mainly driven by the ‘Mag 7’ and market breadth narrowed as the equal weighted S&P 500 declined by 0.7%. While Nasdaq 100 rose by 6.1%, the Russel 2000, the small cap index, fell by 1.1% and the key renewable indices lost about 10%.

As the first half of 2024 has come to an end, the equal weighted S&P 500 index is up by 4% year-to-date, the Russel 2000 index is down by 0.9% and the MSCI World small cap index has increased by 0.6%. Renewable energy has had a tough year, and the two main indices are down by 14% and 16%, respectively.

The Federal Reserve kept interest rates unchanged in June but made a hawkish revision to its dot plot, indicating only one rate cut this year, down from the previously expected three rate reductions. However, this adjustment was considered outdated as it likely did not fully account for the recent weak inflation data. The market is currently pricing in two full cuts for the year.

Following the Fed meeting, the yield on the US 10-year Treasury declined due to weak inflation numbers but the yield rose later in the month following the presidential debate, where Trump gained a significant lead in the polls. A Trump presidency is perceived to be more inflationary compared to a government led by President Biden. Most analysts also anticipate that a Trump presidency would be favorable for the broad equity markets, although it would likely pose risks for the renewable energy sector.

RENEWABLE ENERGY - POLICY RISK AT THE FOREFRONT

We covered the consequences of a Trump presidential win in our monthly report in December 2023: Will and can Trump kill the inflation reduction act (IRA)? Our conclusion was that it is unlikely, even in a red sweep scenario where the Republicans win both the presidency and both Houses of Congress. However, we warned that a Trump presidency, with or without Congressional majority, could reinterpret guidelines for the IRA, making it more strident to qualify for tax credits. We also warned that poll advantages for Trump would likely cause renewable energy stocks to sell off, and vice versa, they would surge if Biden should gain a poll advantage.

Following the disastrous performance from President Biden in the first presidential debate, Trump has taken a significant lead in the polls and the volatility we predicted came earlier than expected. However, the Republicans are not leading in the polls for control of the House, which is required to revoke the IRA. Accordingly, as explained in detail in our December report, even in a red sweep scenario, we still believe a full repeal of the IRA is unlikely.

Interestingly, most comments about Republicans revoking the IRA are made by Democrats rather than high-level Republicans. This could be a tactical move as repealing the IRA may not appeal to independent voters. Therefore, this issue will likely remain a concern for renewable energy equities until after the election in November.

Unfortunately, even if the Democrats retain the White House, the fight against climate change suffered another setback last week as the Trump-appointed U.S. Supreme Court majority overturned the Chevron doctrine. This legal framework allowed federal agencies to interpret and implement ambiguously written laws issued by Congress. With this ruling, it will be easier for federal judges to second-guess regulatory actions, empowering challengers across federal agencies.

The power sector, one of the most regulated in the US, has relied heavily on the Environmental Protection Agency (EPA) to combat climate change. Fortunately, the EPA began to reduce its reliance on the Chevron doctrine in many, but not all, rulemakings several years ago. Nevertheless, the overturning of Chevron has curtailed EPA's authority and will likely lead to a significant increase in legal challenges and delays in policy implementation. This will take years to play out but will likely lead to more emissions and hazardous waste from power generators and industry.

Moreover, the overturn of the Chevron doctrine might result in legal challenges to the IRA guidelines. The IRA was rushed through Congress in the summer of 2022, and it was always intended that scientific experts in the agencies would nail down the details. It is difficult to have a strong view if plausible legal challenges will be successful, but easy to see that they will cause delay and increase uncertainty for renewable energy companies.

Sadly, the political risk also increased on the other side of the Atlantic. In France, President Macron announced a surprise election in early June, and the right-wing party Rassemblement National (RN) or National Rally performed better than expected in the first round of the parliamentary elections. NR is a climate-change sceptic party that has campaigned on not only ending construction of onshore wind but has also claimed it will remove already installed wind farms. Although this was unlikely to ensue even if RN should win a majority in the new parliament, renewable energy stocks and particularly wind OEMs like Vestas and Nordex did poorly in June.

However, at the time of writing, it appears that an alliance between the two other political blocs has not only prevented NR from achieving an absolute majority in the second round of the election, but it has even relegated NR to third place among the three major factions. This means that NR will be far from power, at least for now, and its climate-change sceptic policies will not be implemented. This should be positive news for renewable energy equities. However, it will take time to form a new French government and this uncertainty combined with the fact that the far-left might gain significant power is likely to hamper French stocks over the next weeks.

Despite NR being kept far from power in France, climate-change sceptic parties have gained ground around the world, intensifying the political and regulatory risk for companies involved in the energy transition. Nevertheless, much of this political risk is likely already priced into stocks, the sentiment is negative and can hardly become worse.

We will not attempt to predict the outcome of the US election in November, but with four months to go, and as the French election has shown, nothing should be taken for granted. Also, the US is highly polarized with strong bases on each side, and it is hard to see Trump increasing its lead significantly from the current national poll results. His lead in swing states has increased but it is not insurmountable. The election has become Trump’s to lose. We expect volatility in the polls and in renewable energy equities over the next four months.

While we continue to position long in infrastructure companies essential for the electrification of society and with broad support independent of view of climate-change risk, we are conscious of the tailwind the sector would receive if the Democrats should win the White House and the very next day the FED would cut rates for the first or even second time in this cycle. The strong rally we saw in November and December of last year might pale in comparison.

FUND PERFORMANCE – STRONG RELATIVE PERFORMANCE

Although strong relative returns, the absolute performance was weak in June. In some ways, it was a mirror image of May, where all but the two hydrogen themes contributed positively to the NAV of the fund.

As expected, we recovered all the losses in our hydrogen themes in May, but European hydrogen stocks still have downside to their April lows. The outperformance in Europe versus the US is partly due to an expectation among European companies and investors that the guidelines for IRA hydrogen tax credits will be finalized within June/ July. However, few companies and investors in the US believe this is likely. Although there might be further comments in the near term, the final details are likely to come after the election, delaying large orders pending those guidelines.

We have long argued that without significantly lower electricity prices, green hydrogen will only be competitive in limited cases without massive subsidies. As climate-change sceptic politicians are gaining ground around the world, we doubt that sufficient subsidies will be forthcoming.

The worst performing theme of the month was “US Renewable Development” which deducted 2.8% from NAV. During June, Nextera Energy (NEE) and AES gave up 11% and 19%, respectively, underperforming the S&P 500 utility sub-sector which were down 6% and was the worst performing sub-index in the S&P 500. These large companies typically move in tandem with the broader clean tech industry, but both saw sharp declines following NEE’s investor conference. The company raised its capex expectations for 2027 but kept earnings projections in line with consensus. It seems like investors were taken aback by the need for increased investments to capitalize on the AI-driven data center boom and were disappointed that the earnings from these investments will take years to materialize. We believe it is likely that more companies riding the AI hype may face similar disappointments this year. Still, we continue to believe that NEE and AES will be relative winners among renewable energy developers and although we reduced the NEE position somewhat early in the month, we regard both stocks as core holdings.

The second worst performing theme was “Wind” which lost 1.9% of NAV. This theme only contains European stocks and the two largest, Vestas (VWS) and Nordex (NDX1) both declined by 17% and 19%, respectively. The stocks first fell on the uncertainty around the French election, then dropped further on the increasing chance of a wind-loathing president in the White House.

As the French political risk is in the rear-view mirror, we expect the stocks to recover somewhat in the near term. Also, the stocks should continue to gain from the improved outlook for wind installations in the UK following Labour’s solid win in last week’s parliamentary election. The UK is already the most important offshore wind market outside of China and Labour is targeting to double onshore wind installations and quadruple offshore wind installations by 2030. Political risk might not be a one-way street after all.

Finally, regarding a Trump presidency, we note that he despised wind installations also in the 2016 election, but the best year for US installations was in 2020, his last year in power. We are still optimistic to the wind installers, although we note that order intake has been mediocre so far this year, especially for Vestas.

The third worst performer was the solar theme which deducted 1.6% from NAV. As we explained in the previous monthly report, solar stocks rallied strongly from mid-April to the end of May on possibly optimism on lower interest rates into year-end, but more likely hype around the powering of data centers. As we pointed out in last month’s report, despite stronger demand for solar from AI data centers, there are permitting and connection bottlenecks that will hold back market growth in the near term.

The solar stock we like on this theme is First Solar (FSLR) which is already sold out through most of 2027 and will be able to sell future capacity at higher prices. Still, the stock declined almost 20% in June, following a 54% rally in May. FSLR is the largest winner from the IRA and with speculation around a repeal, it is understandable that many take profit following the strong performance this year. We traded out of about 40% of the position during the month but will rather add than reduce at the current price.

Sincerely

Vidar Kalvoy & Joel Etzler

Past performance is not a guarantee of future returns. The price of the investment may go up or down and an investor may not get back the amount originally invested.

- Portföljförvaltare och grundare av fonden Coeli Energy Opportunities.

- Mer än 15 års erfarenhet av investeringar från både publika och private equity-sidan.

- Förvaltade fonden Coeli Energy Transition under perioden 2019 - 2023.

- Spenderade sex år på Horizon Asset i London, en marknadsneutral hedgefond.

- Började arbeta tillsammans med Vidar Kalvoy 2012.

- Fem år inom Private Equity på Morgan Stanley.

- Startade sin investeringskarriär inom tekniksektorn på Sweden Robur i Stockholm 2006.

- Utbildad Civilingenjör från Kungliga Tekniska Högskolan.

- Portföljförvaltare och grundare av Coeli Energy Opportunities-fonden.

- Förvaltat aktier inom energisektorn sedan 2006 och har mer än 20 års erfarenhet från portföljförvaltning och aktieanalys.

- Förvaltade fonden Coeli Energy Transition under perioden 2019 - 2023.

- Ansvarig för energiinvesteringarna på Horizon Asset i London under 9 år, en marknadsneutral hedgefond.

- Erfarenhet från energiinvesteringar på MKM Longboat i London och aktieanalys inom teknologisektorn i Frankfurt och Oslo.

- MBA från IESE i Barcelona och Civilekonom från Norges Handelshögskola.

- Innan han började arbeta inom finans var han löjtnant i norska marinen.

IMPORTANT INFORMATION. This is a marketing communication.

Before making any final investment decisions, please refer to the prospectus of Coeli SICAV II, its Annual Report, and the KID of the relevant Sub-Fund. Relevant information documents are available in English at coeli.com. A summary of investor rights will be available at https://coeli.se/finansiell-och-legal-information/. Past performance is not a guarantee of future returns. The price of the investment may go up or down and an investor may not get back the amount originally invested. Please note that the management company of the fund may decide to terminate the arrangements made for the marketing of the fund in one or multiple jurisdictions in which there exists arrangements for marketing.