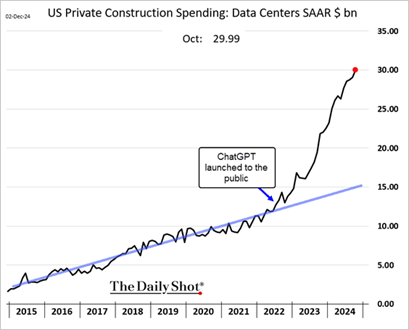

The demand for electricity driven by AI is surging at an unprecedented pace. Since the introduction of ChatGPT, spending on data centers (DCs) has skyrocketed, showing no signs of slowing down.

Source: TheDailyShot, The United States Census Bureau

While the easy-to-develop sites for data centers have been claimed, the next phase of expansion will be more challenging. As discussed in previous reports, such as March 2024’s ‘Roadblocks on the AI Highway’, the single greatest obstacle to AI growth is securing grid connections and reliable power supplies.

Electrical grids across the US are congested, with regulators increasingly voicing concerns that DCs are consuming disproportionate amounts of power, potentially driving up energy costs for consumers. This is facing increasing resistance, and the Chairman of the Public Utilities Commission of Texas (PUCT) recently stated that DC developers will need to supply generate some of their own power since "they can afford it." This concept of asking large users like hyperscalers to add their own power is known as ’additionality’ and it is gaining traction across the US.

A recent notable example is Microsoft’s 20-year Power Purchase Agreement (PPA) with Constellation Energy (CEG), a holding in the fund, to restart a reactor at the Three Mile Island nuclear power plant that was shuttered as recently as in 2019. While the costs of the deal are substantial and Microsoft is paying a significant premium over grid prices, the agreement appears to be a clear win for both Microsoft and Constellation Energy (CEG).

However, opportunities like this are limited, and innovative DC developers are increasingly willing to pay ever-higher premiums for power that is immediately available. This strategy makes sense, as the high capital costs of DCs and their expected returns make ‘time to power’ far more critical than the ‘cost of power’. Until clearer data emerges on the returns from these investments, we expect this trend to continue.

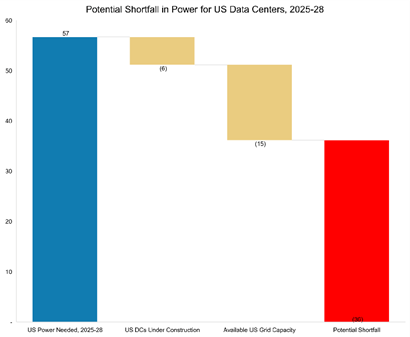

On the current trajectory, DC power demand is likely to significantly outpace potential supply over the next years. Morgan Stanley projects a staggering 36GW power shortfall for US DCs between 2025 and 2028. This is more than twice Sweden’s total electricity consumption. The estimate, based on anticipated 57GW of DC power demand from AI hardware investments less the power secured from DCs already under construction, highlights the critical challenge ahead.

Source: Morgan Stanley

Although this is a crude calculation, we believe it is directionally accurate and worth investigating the different options available to data center (DC) owners to address their growing power demands.

1. Renewable Energy: A Partial Solution

Hyperscalers, the largest owners of DCs, have ambitious decarbonization targets and would prefer to rely solely on renewable energy, even at premium prices. Unfortunately, renewable energy alone cannot meet DCs’ constant load requirements. Batteries can help smooth fluctuations but are currently too expensive and slow to deploy at the necessary scale.

Renewable energy, therefore, can only be part of the solution, requiring either a robust grid connection or other forms of power backup. On the bright side, hyperscalers are likely to continue to drive demand for renewable Power Purchase Agreements (PPAs) to offset emissions from other power sources. However, current demand for renewables already far outpaces supply, which is hindered by permitting delays, lack of grid access, and equipment shortages. These are logistical challenges and will be resolved over time. The fund is positioned to benefit from this trend through investments in leading US renewable developers such as NextEra Energy (NEE) and AES.

2. Nuclear Power: Limited Potential

Could nuclear energy fill the gap? While notable examples like Microsoft’s deal to restart a reactor at Three Mile Island are promising, these opportunities are rare. Only a handful of shuttered reactors are supposedly economically viable for reactivation, and all are likely less attractive than Three Mile Island.

What about new large-scale nuclear reactors? The few that have been built in the West the last decades have taken literally decades to build and with huge cost overruns. Either way, they would not be a solution for time constrained DC owners.

A better option might be Small Modular Reactors (SMRs) that come with outputs of about 200-300MW and the promise of lower costs and shorter construction time. In fact, hyperscalers like Google and Amazon are already supporting SMR startups, although we question the authenticity of their backing. Neither of these SMR startups have approval from the Nuclear Regulatory Commission (NRC), which easily could take at least four to five years. Since financial commitments are not until the construction phase, any cash outlays are many years into the future. This could resemble a cheap PR option, and we can only wonder why they did not decide to back more established SMR companies. In any case, new nuclear solutions are unlikely to address the immediate power shortage and significant contributions are likely a decade or more away.

3. Natural Gas: A Practical Stopgap

Natural gas, which currently accounts for nearly 45% of US electricity generation, offers a readily available resource to meet DC demands. While it is not a clean energy source, it emits less carbon than coal and could serve as a decent power option even from a climate perspective when paired with renewables and batteries.

Despite its advantages, natural gas infrastructure is arduous and time consuming to develop. Power plants take more than five years to construct, and pipelines require often even longer to plan, permit and build. However, the Trump administration’s favorable stance on domestic fossil energy development will likely accelerate these projects.

For example, META recently announced plans to construct a USD 10 billion AI-focused DC in Louisiana, near three new natural gas-fired power plants being built by Entergy at a cost of USD 3.2 billion. This will be METAs largest data center globally. However, note that META is sticking to its decarbonization target and has committed to offsetting 100% of its electricity use with clean, renewable energy. The fund stands to benefit from the buildout of gas infrastructure through investments in companies like MasTec (MTZ), Chart Industries (GTLS), and Siemens Energy (ENR).

4. Fuel Cells: An Emerging Solution

With the low hanging fruits picked, innovative approaches such as fuel cells are gaining attention. For instance, AEP, a major US utility, recently agreed to purchase up to 1 GW of fuel cells from Bloom Energy, a leading manufacturer in the space. While these fuel cells are primarily powered by natural gas, they produce fewer air pollutants and similar greenhouse gas (GHG) emissions compared to traditional gas power plants. Moreover, they could eventually transition to green hydrogen, however we doubt this will happen any time soon.

Bloom Energy still needs to prove that its fuel cells can scale effectively to meet the rigorous uptime requirements of DCs. Nevertheless, given the lengthy procurement times for gas turbines, fuel cells may emerge as a vital stopgap as energy demand continues to grow. The fund is closely monitoring developments in this space.

5. Repurposing Industrial Sites and Bitcoin Mining Facilities

Another innovative approach is repurposing existing industrial sites with substantial grid connections and ample land resources. Sites of soon-to-be-closed industrial facilities that are no longer economically viable are ideal candidates. The profitability of the DC business is so high that it may even make sense to acquire less profitable businesses solely to convert their land and energy infrastructure for DC use.

One particularly intriguing solution involves targeting bitcoin miners. These companies often own large sites with high grid power connections and long-term contracts for clean energy. In some cases, it might even make sense to shut down bitcoin mining operations and repurpose these facilities for High-Performance Computing (HPC) DCs. The fund has invested in a few bitcoin miners for this reason.

Conclusion: An "All of the Above" Approach

To sum up, we believe that addressing the power shortfall will likely require an “all of the above” approach. From renewables and batteries to nuclear, gas, and innovative technologies, every avenue will have to be explored. As long as the market is willing to fund the continued expansion of AI development, the race to secure reliable power will remain intense, shaping the future of the energy market.

- Portföljförvaltare och grundare av fonden Coeli Energy Opportunities.

- Mer än 15 års erfarenhet av investeringar från både publika och private equity-sidan.

- Förvaltade fonden Coeli Energy Transition under perioden 2019 - 2023.

- Spenderade sex år på Horizon Asset i London, en marknadsneutral hedgefond.

- Började arbeta tillsammans med Vidar Kalvoy 2012.

- Fem år inom Private Equity på Morgan Stanley.

- Startade sin investeringskarriär inom tekniksektorn på Sweden Robur i Stockholm 2006.

- Utbildad Civilingenjör från Kungliga Tekniska Högskolan.

- Portföljförvaltare och grundare av Coeli Energy Opportunities-fonden.

- Förvaltat aktier inom energisektorn sedan 2006 och har mer än 20 års erfarenhet från portföljförvaltning och aktieanalys.

- Förvaltade fonden Coeli Energy Transition under perioden 2019 - 2023.

- Ansvarig för energiinvesteringarna på Horizon Asset i London under 9 år, en marknadsneutral hedgefond.

- Erfarenhet från energiinvesteringar på MKM Longboat i London och aktieanalys inom teknologisektorn i Frankfurt och Oslo.

- MBA från IESE i Barcelona och Civilekonom från Norges Handelshögskola.

- Innan han började arbeta inom finans var han löjtnant i norska marinen.

IMPORTANT INFORMATION. This is a marketing communication.

Before making any final investment decisions, please refer to the prospectus of Coeli SICAV II, its Annual Report, and the KID of the relevant Sub-Fund. Relevant information documents are available in English at coeli.com. A summary of investor rights will be available at https://coeli.com/financial-and-legal-information/. Past performance is not a guarantee of future returns. The price of the investment may go up or down and an investor may not get back the amount originally invested. Please note that the management company of the fund may decide to terminate the arrangements made for the marketing of the fund in one or multiple jurisdictions in which there exists arrangements for marketing.